U.S. Firearms Industry

Today 2020

Pandemic, Social Unrest & Election Year

Combine For Record Sales Surge

The launch of the “Roaring 2020s” has played out more like a cinematic drama than reality as the U.S. has lurched from one sensational scene to another. In the first half of this year alone, Americans witnessed the third impeachment of a sitting president, the intensive spread of the novel coronavirus, a subsequent weeks-long economic shutdown leading to record unemployment, followed by days of nationwide protests in the wake of George Floyd’s death — all against the backdrop of a critical presidential election year.

Amidst the uncertainty, the U.S. firearms industry is booming. Consumers have responded to events around them by visiting local dealers at unprecedented levels. And, as dealers roundly report: many of them are first-time gun owners with little to no previous experience with firearms or even the desire to be a firearms owner until the pandemic and nationwide protests hit. It has presented the industry with a golden opportunity to welcome these new gun owners — and the responsibility to ensure they’re properly educated.

“It’s gone bananas,” said Jacquelyn Clark, owner of Lakewood, Colo.’s Bristlecone Shooting, Training & Retail Center. “There are lots of new gun owners as a result of this pandemic. It will be all about how we as an industry bring these new folks in to the fold and keep them engaged via education over the next few months.”

One of the reasons why sales have skyrocketed is the virtue of industry businesses remaining open through the pandemic. In last month’s issue, NSSF President and CEO Joe Bartozzi detailed the behind-the-scenes efforts his organization has taken to secure “essential” designation for industry businesses, as well as working with the ATF to provide guidance on sidewalk/curbside transactions.

“This crisis validates what we’ve been saying forever: a Constitutional right is just that — a right,” Bartozzi emphasized. “You never know when people are going to feel the need to exercise their rights. There are potentially a million or more new gun owners just in the last couple months. So now, we have to be most welcoming.”

If these first six months are anything to go by, the industry is in for a wild rest of 2020.

What They’re Buying

In the early days of the pandemic, dealers reported robust activity from customers — wiping out entire in-store firearms inventories in many cases.

“A surge would be an understatement,” said David Rich, owner of Naples Gun Shop & School in Naples, Fla. “Daily, we’re selling out of GLOCKs and have to stay up late hours finding available replacements through our distribution network. Our new customers are looking into Taurus, SCCY and other brands — basically telling us they’ll purchase whatever we have.”

The outbreak fueled renewed interest in a category that has gradually tapered off in recent years: shotguns.

“Shotgun sales are through the roof,” said John Phillips, president of PWG Range in Poway, Calif. “We can’t keep shotgun ammunition in stock. Then, it’s home-defense ammunition — hollowpoints specifically. After that, it’s handguns and ARs, in that order.”

Dealers have taken creative measures to combat extinguished inventory. Charlotte, N.C.-based Hyatt Guns’ Larry Hyatt shared with SI correspondent Tim Barker after his stock of self-defense shotguns quickly sold out, he directed his in-house gunsmith to shorten untouched hunting shotgun barrels to repurpose them for home-defense use — resulting in 40 fresh options for customers.

“A lot of these people don’t really want a gun. What they want is self-protection,” Hyatt noted.

NSSF released some preliminary data on what dealers have observed in their stores, publishing the results of a survey sent out in May. Through the first four months of the year, respondents estimated 40.2% of customers coming into their storefronts were first-time gun buyers, spending an average of $594.95. (Dealers also deemed semi-auto handguns, shotguns and MSRs as the three top-selling categories during this period.)

A noteworthy number in a collection of staggering statistics: Of those first-time buyers, dealers estimate about 40% of them were female. Not surprisingly, when asked what the likely motivation was behind the firearms purchase, dealers determined it was for personal protection purposes.

Responding dealers gauged about a quarter (24.7%) of these first-time buyers had previously taken some form of a firearm safety training course prior to the pandemic. In an encouraging sign, dealers shared almost two-thirds (62.9%) of these gun buyers asked about taking a firearms safety training course

Post-pandemic follow-ups will prove crucial to retaining them as repeat customers.

“Past NSSF research has shown in order to keep new owners active and avoid them becoming lapsed participants, they’ll need information on topics such as how to safely own, operate and secure their new purchase,” said Jim Curcuruto, NSSF director of research and market development. “Additionally, these new gun owners will need an invitation to go to the range or to the field to learn about firearm safety, personal protection and the recreational side of gun ownership.”

NICS Background Checks Jan. 2015–June 2020 (NSSF-Adjusted)

NICS Background Checks July 2015–Dec 2020 (NSSF-Adjusted)

NICS Records Shattered

As further evidence to the unprecedented nature of the 2020 business year, NICS background checks have shattered records. While not a direct correlation to firearms sales, background checks provide an additional perspective of current business trends. And for comparison purposes, the trend is unequivocally up.

From Jan. 1 to May 31, there were 8,115,139 background checks (NSSF-adjusted) reported by NICS. At this point in recent banner years, NICS (NSSF-adjusted) background checks totaled 7,085,881 in 2013 and 6,206,763 in 2016 — both widely outpaced by 2020.

Another sign of these dramatic times: five of the 10 single busiest days in the NICS system’s history were recorded in March (March 17–21) and five of the busiest weeks ever for the 21-year-old system took place in March and April.

NSSF-adjusted background checks recorded in March (2,375,525), April (1,678,223) and May (1,595,790) represent record marks. Comparing these totals to the corresponding month in 2019 provides additional context: The totals observed in 2020 are increases of 80.4%, 69.1% and 75.2% over last year.

Even before the recent sales surge, however, NSSF-adjusted background checks were trending above those of the previous year dating back to May 2019.

Top 25 U.S. Manufacturers 2018

Industry’s Economic Impact Rises

The industry has weathered its share of ebbs and flows over the past decade, but its economic footprint continues to rise. Early April, NSSF released its 2020 Firearm and Ammunition Economic Impact Report, revealing the firearm industry’s economic impact increased from $19.1 billion in 2008 to $60 billion in 2019 (213%). The number of full-time equivalent jobs rose 100% over the corresponding period, from 166,000 to 332,000.

Year-over-year, the industry’s economic impact jumped 15.4% ($52 billion in 2018 to $60 billion in 2019). Jobs likewise experienced a boost, rising from 312,000 to 332,000.

“Our industry continues to show the steady and reliable growth that’s a hallmark of a healthy industry,” Bartozzi observed. “The workers who comprise our ranks are the fabric of our communities. They produce the highest quality firearms and ammunition that millions of law-abiding Americans rely upon to exercise their fundamental right to keep and bear arms and safely enjoy the recreational shooting sports.”

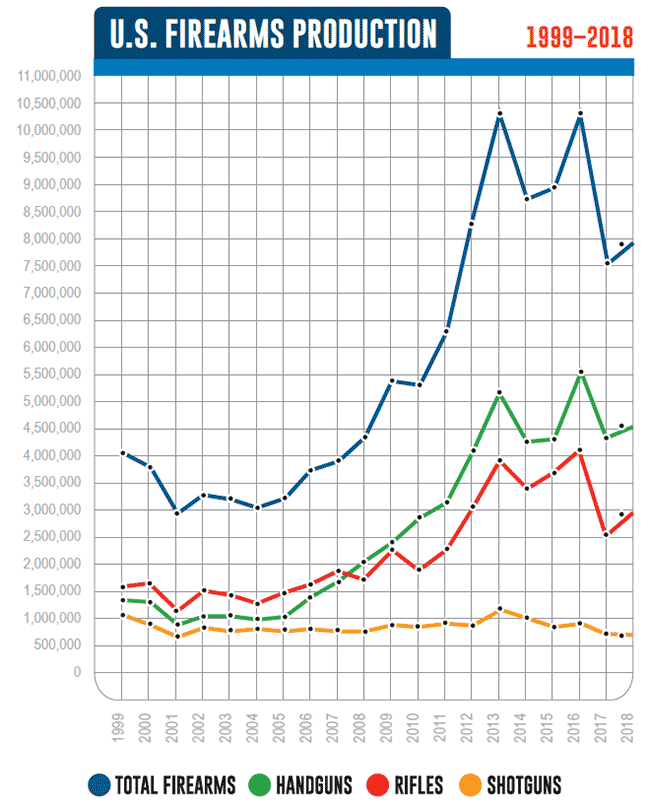

Total U.S. Firearms Production 1999–2018

Ruger, Smith & Wesson Financial Insights

With each of the industry’s two largest firearms producers being publicly traded, their earnings releases shed additional light on the current state of the market.

May 6, Ruger reported Q1 2020 net sales totaled $123.6 million — up 8.4% over the corresponding 2019 quarter ($114 million). Sales of new products, including the Wrangler, Ruger-57, LCP II in .22 LR, PC Charger and AR-556 pistol, represented 20% of firearm sales during the quarter.

In his observations regarding Ruger’s financial performance, President and CEO Chris Killoy attributed the increase to “strong consumer demand, exciting new products and reduced reliance on promotions.”

Of course, the pandemic was a factor in strong sales.

“The impact of COVID-19 has increased in the past month, but we have been fortunate and have been able to keep all of our facilities safe and open with only limited restrictions on production,” Killoy reported. “We’re well positioned to manage through this global crisis as we continue to monitor and adjust our mitigation efforts daily.”

(Additional insights into the pandemic’s impact will be further revealed in the company’s Q2 2020 filing — projected to be publicized July 29.)

As part of a planned spinoff announced last November to create two independent, publicly traded companies, Smith & Wesson Brands Inc. formally changed its name from American Outdoor Brands Corp. (AOBC) on June 1. (Smith & Wesson Brands Inc. encompasses the firearms business, while American Outdoor Brands Inc. encompasses the outdoor products and accessories business.)

“The name change of our parent company is an important step toward spinning off our outdoor products and accessories business, which remains on track to occur in late summer,” said Barry Monheit, chairman of the board. “We believe separating into two independent public companies will allow each organization to better align its strategic objectives with its capital allocation priorities.”

March 5, in its most recent filing, AOBC announced its Q3 2020 performance, which resulted in an increase over the corresponding 2019 quarter — rising from $162 million to $166.7 million.

“Third quarter revenue in our Firearms segment was favorably impacted by changes in the timing of our excise tax assessment, as well as the positive impact of our new M&P9 Shield EZ pistol, which is built for personal protection and every day carry, and was displayed at SHOT Show in January,” said Mark Smith, AOBC co-president and CEO. “That positive impact, however, was partially offset by lower than anticipated orders from certain strategic retailers across multiple product categories.”

(The company’s full fiscal 2020 results were released June 18, after press time on this issue. It’s available at

www.ir.smith-wesson.com)

A Look Back To 2018

In light of recent events the 2018 business year seems much longer than 18 months ago, but ATF’s 2018 Annual Firearms Manufacturing and Export Report (AFMER) — the latest data available, released Jan. 2020 to comply with the Trade Secrets Act — provides key insight for long-term U.S. firearms production and export trends.

Domestic firearms production experienced a modest rebound in 2018, with 7,962,655 firearms produced — a 5.2% increase over 2017 (7,569,158). After a sizable 29% year-over-year (YOY) drop from 2016 (which yielded a record 10,664,318 firearms), an increase over 2017 was a step in the right direction.

Pistol and rifle production surpassed 2017 totals, while revolvers and shotguns endured a decline. (Not included in final production totals for this SI report, the misc. firearms category recorded its highest ever tally in 2018: 1,089,973. According to ATF, examples of miscellaneous firearms include pistol grip firearms, starter guns and firearms frames and receivers.)

U.S. Handgun Production 2018

Handgun Production Insights

There were 4,545,993 handguns produced in 2018, a nominal 3% gain over 2017’s total (4,411,927). Pistols fueled the increase, up 5.2% (from 3,691,010 in 2017 to 3,881,158), while revolver production slipped 7.8% (from 720,917 in 2017 to 664,835). The pistol mark was the third-highest on record (after 2016 and 2013); the revolver total represented a seven-year low.

Taking a closer look at production by caliber, 9mm pistols eclipsed the 2-million barrier for the second time ever — totaling 2,099,319 — jumping 19.5% over 2017 (1,756,618). SIG SAUER was the leading 9mm producer (505,749), which very likely correlates to the release of the P365 in Jan. 2018. Production for pistols in .380 dropped 10% to 760,812, the category’s lowest total since 2012.

Smith & Wesson was the top handgun producer, a position it has held since 2014. The leader in both pistol and revolver production, Smith & Wesson was the only manufacturer to produce more than 1 million handguns in 2018 (1,097,250). However, this year’s figure was an 11.5% drop from its 2017 total (1,239,834).

Fourteen manufacturers produced more than 50,000 handguns in 2018. Of those, several posted gains over 2017: SIG SAUER, GLOCK, Kimber, SCCY Industries, Springfield Armory, Browning, Taurus USA, Beretta, KelTec and Colt’s Mfg.

Long-Gun Production Insights

The rifle category has endured significant swings over the past decade, none more so than the dramatic 40.9% plunge from 2016 (4,239,335) to 2017 (2,504,092). In 2018, rifle production posted a 15% YOY improvement: 2,880,536. While a welcome increase, the total in 2018 is still some distance from what was recorded in 2012–2016 — with each of those years producing 3.1 million rifles or more.

For the second consecutive year, Ruger was the leading rifle manufacturer — producing 731,585 rifles, a 10.7% jump over its 2017 mark (661,155). Ruger’s new-for-2018 introductions included the PC Carbine and Ruger Precision Rimfire.

Shotgun production dropped to a historic low, with 536,126 produced in 2018. This marked a 17.9% decline from 2017 (653,139). According to our research, the 536,126 mark is the lowest recorded shotgun production total since 1958, when 531,000 were produced.

(Editor’s Note: We contacted ATF to confirm the 2018 shotgun production total. While the agency verified the 2018 number, it’s important to keep in mind it only includes what was received for the reporting year — therefore, it may not encompass all shotguns produced if any manufacturers didn’t report.)

O.F. Mossberg & Sons/Maverick Arms Inc. was the top-producing shotgun manufacturer for the second consecutive year in 2018. Emblematic of the category’s declining total, the two largest shotgun producers, Mossberg and Remington, experienced marked declines of 17.7% (from 302,830 in 2017 to 249,183 in 2018) and 42.2% (from 269,391 in 2017 to 155,488 in 2018), respectively.

The Top 5

For the second year in a row, and 10 of the past 11 years on record, Ruger was the largest U.S. firearms manufacturer in 2018: producing 1,581,717 firearms. Ruger was the most prolific long-gun producer (731,595) and second-largest handgun manufacturer (850,122).

The only other manufacturer to surpass the 1-million plateau, Smith & Wesson produced 1,375,850 firearms in 2018. As noted earlier, it was the top handgun producer and fourth-largest rifle producer.

SIG SAUER’s steady rise was punctuated by its inclusion in the top-three largest U.S. manufacturers. Across its pistol and rifle lines, it produced a company-record 661,954 firearms in 2018. Of note, nearly 80% of the firearms produced by the company were 9mm pistols.

Remington was the fourth largest manufacturer in 2018, with 462,555 firearms produced.

With 385,708 long guns produced, Savage Arms rounds out the top five largest U.S. firearms manufacturers. Its 2017 production totals were not included in last year’s AFMER data, but the 2018 figure is a 17.6% increase over 2016 (328,048).

International Business

Total U.S. exports increased 12.7% in 2018 over 2017, rising from 485,968 to 548,111 — a record. Pistol exports grew by 21% compared to 2017 (275,424 to 333,266). This continued a three-year trend: pistol exports observed each year since 2016 have been record totals. Rifle exports also increased in 2018, up 4.2% from 2017 (158,871 to 165,573). Revolver and shotgun exports dropped 0.8% and 7.4%, respectively.

With 170,105 firearm exports, SIG SAUER was the top U.S. exporter for the third year running. GLOCK (110,943) and Remington (59,569) round out the three leading exporters. GLOCK’s international business experienced great gains in 2018, more than doubling its 2017 total (47,861).

Using the latest data from the U.S. Census Bureau Economic Indicators Division, U.S. import numbers from 2019 are available. Compared to 2018’s total of 4,022,364 imported firearms, U.S. companies imported 3,707,461 firearms last year.

While handgun imports decreased by 9.4% in 2018, both rifles and shotguns recorded increases, rising 17.5% and 18.9%, respectively. For the first time since 2013, the U.S. imported more than 500,000 shotguns.

For the fourth year running, Austria was the top importing country — with the U.S. importing 931,941 firearms (-22.5%). Brazil returned as the second-largest importing country, with 861,791 firearms (+13.4%), a position it has held since 2015.

Other top importing countries include: Turkey (368,322 [+15.6%]), Germany (344,986 [-2%]) and Italy (308,622 [+0.24%]).

According to our records, 2018 marked the first time Turkey appeared in the top three importing countries.

A Decade Of Records

Next year’s report will dissect ATF’s 2019 AFMER data — capping what will be a record-setting decade for the U.S. firearms industry. Have a comment after reading this report? Send the SI team an email: editor@shootingindustry.com.