U.S. FIREARMS INDUSTRY TODAY

Peaks & Valleys: A Cyclical Industry On Display

Over the past two years, the U.S. firearms industry has faced both unprecedented opportunities and mounting obstacles.

Opportunity: Since the start of 2020, an estimated 14 million Americans have joined the ranks of firearms ownership.

Obstacle: After a period of record-breaking sales, disarray in the supply chain and the industry’s allocation model have disproportionately impacted independent dealers’ ability to serve customers.

Opportunity: These 14 million first-time gun buyers have made the gun-owning community more diverse than it has ever been before.

Obstacle: The anti-gun/industry movement has been reenergized following tragic shootings in Buffalo, N.Y. and Uvalde, Texas, causing further uncertainty in the market.

There are dozens more. Here, as we mark the halfway point of 2022, the U.S. firearms industry is preparing to face additional market volatility. The threat of new laws at the state and federal level could push customers into a fear-induced buying mode once again.

Economic Impact Increases

Despite its cyclical nature, the U.S. firearms and ammunition industry has experienced admirable growth since 2008 — outlasting The Great Recession and widespread shutdowns that impacted “non-essential” industries in 2020.

According to NSSF’s 2022 Firearm and Ammunition Industry Economic Impact Report, the industry’s total economic influence ballooned from $19.1 billion in 2008 to $70.52 billion in 2021, a 269% jump. Year-over-year, the industry’s economic impact rose 11.1% (from $63.5 billion in 2020).

Corresponding with a rising economic impact, the total number of full-time equivalent jobs in the industry increased from approximately 166,000 in 2008 to over 375,000 in 2020 (126% increase). From 2020 to 2021, total jobs grew from 342,330 to 375,819 (9.8%).

In addition, these ascending figures contributed to the firearm and ammunition industry paying over $7.85 billion in business taxes (both federal and state), including property, income and sales-based levies. An additional $1.1 billion was paid in federal excise taxes, which directly contributes to wildlife conservation.

“The economic contributions of our industry are indisputably contributing to every state and every community. This is the hallmark of the hard-working men and women who prove that the American firearm and ammunition industry is strong,” said Joe Bartozzi, NSSF president and CEO. “The growth of firearm and ammunition manufacturing year-after-year shows this industry continues to meet the American demand for lawful firearm ownership. Since 2008, federal tax payments increased by 206%, Pittman-Robertson excise taxes that support wildlife conservation by 214% and state business taxes by 151%.”

This NSSF report also provides state rankings, detailing insights on total economic output and jobs. Texas and California lead the way in total economic output and jobs. New Hampshire and Wyoming are ranked first and second in total economic output per capita and jobs per capita, respectively. As of 2021, Wyoming demonstrated the highest levels of growth in its economic output and jobs.

NICS Background Checks Jan. 2017–May 2022 (NSSF-Adjusted)

NICS Background Checks July 2017–Dec 2022 (NSSF-Adjusted)

NICS Checks Update

Through May 31, there have been 6,747,238 (NSSF-adjusted) NICS background checks in 2022. Although this total significantly lags behind figures observed at this point in 2021 (8,501,879) and 2020 (8,115,139), it’s still the fourth highest on record (in third, Jan.–May 2013 logged 7,085,881 background checks).

Year-over-year, the drop in NICS checks totaled 20.6%. However, when compared to the most recent “non-peak year” (2019), there were 5,317,913 checks recorded through Jan.–May 2019 — placing the total observed so far in 2022 up 26.88%.

“Although the firearms market remains elevated and healthy with new entrants, it has cooled significantly from the height of the pandemic surge and seems to now be following pre-pandemic historical demand patterns.”

Mark Smith, Smith & Wesson President & CEO

Of note, the NICS system has recorded at least 1 million checks every month since Aug. 2019 — a span of 34 consecutive months. (The previous record streak was June 2016–Apr. 2017.)

While NICS figures are not a direct reflection of firearms sales, they do provide an added perspective of current market conditions. Current events, like the renewed gun control push, will likely hold consumers’ attention moving forward.

Ruger, S&W Latest Financials

The industry’s two largest U.S. firearm producers — Smith & Wesson and Ruger — are publicly traded, giving real-time insights into the state of the U.S. firearms market. Each company has generated exceptional sales figures during the past two years.

Feb. 23, Ruger announced its 2021 net sales figures of $730.7 million, increases of 28.4% over 2020 net sales ($568.9 million) and 78.0% from 2019 net sales ($410.5 million).

May 5, Ruger reported Q1 2022 net sales of $166.6 million, down from $184.4 million in Q1 2021 (-9.7%).

“During the quarter, consumer demand for firearms subsided from the unprecedented levels of the surge that began early in 2020, resulting in the 10% reduction in our sales,” said Ruger CEO Chris Killoy. “Consequently, we shifted our production mix to allow for a healthy replenishment of Ruger firearms in our warehouses and in the distribution channel, as inventories of many of our product families were depleted in 2020.”

Sales of new products, including the PC Charger, MAX-9, LCP MAX and Marlin 1895, represented $21.4 million (13%) of firearm sales during the quarter.

Ruger reintroduced the Marlin line Dec. 2021, which has been well received in the consumer market, according to Killoy.

“We continue to increase production volumes and look forward to re-introducing additional Ruger-made Marlin lever-action rifles throughout this year,” he said. “We’re just scratching the surface of the value that Marlin products and the Marlin brand will bring to Ruger.”

Sept. 2021, Smith & Wesson announced a decision to move its headquarters and “significant elements” of its operations to Maryville, Tenn., starting in 2023. This decision came as a result of legislation proposed in Massachusetts — Smith & Wesson’s home since 1852 — that would have prohibited the company from manufacturing certain firearms in the state.

According to Smith & Wesson President and CEO Mark Smith, these products made up more than 60% of the company’s revenue the previous year.

March 3, Smith & Wesson reported its Q3 2022 financial results. Net sales totaled $177.7 million, a 30% drop from the corresponding 2021 quarter ($257.6 million) but 139.5% higher than Q3 2020 ($127.4 million).

“Although the firearms market remains elevated and healthy with new entrants, it has cooled significantly from the height of the pandemic surge and seems to now be following pre-pandemic historical demand patterns,” Smith observed.

Smith noted the company is well suited for the cyclical nature of the industry, hailing Smith & Wesson’s agile production model.

“This macro demand pattern is very familiar to us, and is exactly what our business model is designed to accommodate,” he said. “Our ability to ramp production aggressively to meet surging demand over the past couple of years fueled significant market share gains for Smith & Wesson and provided a demonstrable proof point for our flexible manufacturing strategy.”

June 23, Smith & Wesson announced its Q4 2022 and full year fiscal 2022 financial earnings. Q4 2022 quarterly net sales were $181.3 million, compared to $322.9 million (a decrease of 43.9%); full year net sales for 2022 were $864.1 million, compared to $1.1 billion (a decrease of 18.4%).

2020 Firearms Production: In Context

Using the latest available data from ATF — the 2020 Annual Firearms Manufacturing and Export Report (AFMER) — insights into 2020 U.S. firearms production were published earlier this year.

2020 is a year that will forever be linked to the “perfect storm” of uncertainty surrounding the emergence of the COVID-19 pandemic (and subsequent shutdowns, short-term food shortages and the realization individuals may need to become their own first responders, etc.) across the U.S. in spring 2020, a summer of social unrest and a contentious election cycle — with the legitimacy of the results still being disputed to this day.

These factors led to millions of first-time gun buyers joining our ranks (NSSF estimates 8.4 million in 2020 alone), and numerous NICS background checks records falling. At the close of 2020, there were 21,083,643 (NSSF-adjusted) NICS background checks, obliterating the previous record set in 2016 (15,700,471).

While 2020 represented the highest demand year, it was not — perhaps surprisingly — a record production year for the U.S. firearms industry. In 2020, U.S. firearms manufacturers produced 9,739,335 firearms — the third-highest total, according to our records. The top two producing years occurred when U.S. firearms manufacturers passed the 10 million mark in both 2016 (10,664,318) and 2013 (10, 349,650).

These top-producing years had a notable advantage over 2020, however. Providing context, each year was a relatively “stable” year. Yes, 2016 was defined by the showdown between Donald Trump and anti-gun Hillary Clinton, while 2013 brought fear-induced buying in response to President Obama’s early-2013 executive actions that targeted the industry — but neither year faced the wave of unprecedented obstacles that appeared in 2020.

Supply chain challenges, raw material sourcing, COVID-impacted shutdowns and other product shortages impacted business in 2020, to name a few. Likewise, the fallout from 2017’s unexpected, precipitous drop in consumer demand was still being felt across the industry. No one expected a two-year demand surge in March 2020.

2020 Firearms Production: Historical Comparison

The events of 2020 certainly kickstarted a widespread recovery in the industry. After hitting a near 10-year low in firearms production in 2019 (6,353,124), the jump to 9,739,335 firearms in 2020 was a remarkable 53.3% year-over-year (YOY) turnaround.

Dating back to 1975, there was only one other year with a greater YOY jump in total U.S. firearms production: 1993 experienced a 66.5% increase over 1992 (from 3,007,787 to 4,976,289).

Dramatic fluctuations in firearms production is nothing new, however, with 13 of the past 20 years recording double-digit YOY percentage swings. (In a positive, though, nine years have had double-digit increases in YOY firearms production).

After 2019 yielded the lowest handgun production total observed since 2011, 2020 handgun production rebounded in impressive fashion — with 6,502,261 handguns produced, a record for a calendar year in the U.S. (The previous record year was achieved in 2016, when 5,576,366 handguns were made.) It will come as little surprise to learn the “Up to 9mm” pistol category paced handgun production, with about three out of every five handguns produced in the U.S. during 2020 (58.3%) a 9mm pistol.

U.S. rifle production also improved in 2020, rising from 2,226,625 to 2,760,392 (24% increase). This rifle production total is the seventh-highest observed since 2001.

Continuing a trend of the past several years, U.S. shotgun production dropped to its lowest level in decades, with 476,682 produced. (There are two factors in play here. One: Remington, once a powerhouse in the market, produced 404 shotguns in 2020, the year it declared bankruptcy and its assets were sold off. Two: U.S. shotgun imports have risen dramatically, which we’ll cover in the “International Business Trends” section.)

Miscellaneous firearms, not included in the annual firearms total, also experienced a YOY recovery, with 1,324,743 produced — a record tally for the category. The 2020 total resulted in a sizable 39.9% gain over 2019 (946,929).

Top 100 U.S. Manufacturers 2020

Top Producers

For the first time since 2016, Smith & Wesson was the largest U.S. firearms manufacturer — producing 2,320,963 firearms, a new benchmark in U.S. firearms production. (Ruger produced 2,180,780 firearms in 2013, while S&W’s previous company record was 2,120,910, set in 2016.) 2020 represented an impressive resurgence for S&W, which saw its YOY increase more than threefold: 214.8% (from 737,365 in 2019).

Smith & Wesson was the top handgun producer (1,827,507) and second-largest rifle maker (493,456). In the “Up to 9mm” pistol category alone, S&W surpassed its entire 2019 firearms total — producing 937,933 pistols. No coincidence, S&W added a 9mm option to the M&P EZ lineup at the end of 2019, which likely commanded a sizable portion of its 9mm production. S&W’s YOY production in the “Up to 9mm” category represented a 218.9% increase (294,158 to 937,933).

With total firearms production reaching 1,659,324, Ruger was the second-largest U.S. firearms maker in 2020. Ruger’s YOY production increased 30.5%, rising from 1,271,879 in 2019, when it was the only maker to eclipse the 1 million production mark. Ruger was the largest producer of long guns, totaling 617,731 — a position it has held since 2018 — as well as the second-largest revolver maker.

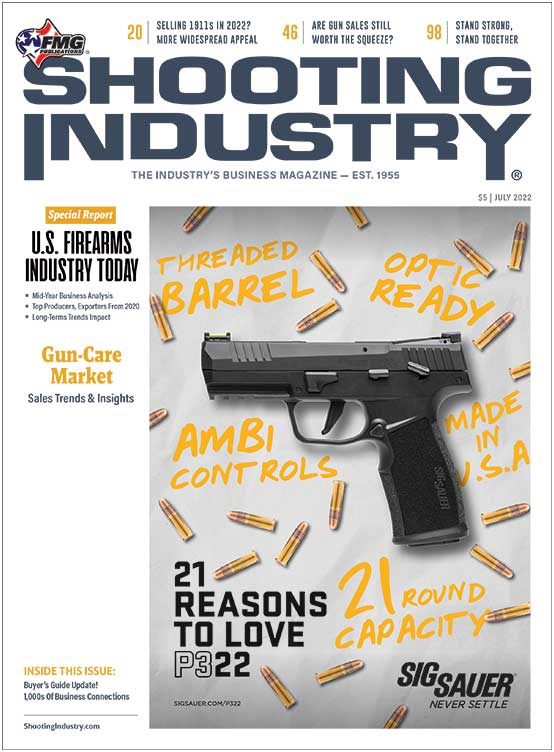

SIG SAUER strengthened its grip in 2020 as the third-largest firearms manufacturer in the U.S., a position it has held since 2018. SIG produced more than 1 million commercial firearms for the first time in its history (1,077,019), according to our records — manufacturing more than 1 million pistols alone (1,019,063), the second-highest producer in the category. The bulk of SIG’s pistol production continues to come from the “Up to 9mm” category, constituting 92.1% of its 2020 production (937,933 of 1,018,063).

While 2020 represented the highest demand year, it was not — perhaps surprisingly — a record production year for the U.S. firearms industry.

Total U.S. Firearms Production 2001–2020

Combined, the top three 2020 U.S. firearm manufacturers covered 59.8% of the domestic handgun segment, 42.3% of the rifle market and 51.9% of total firearms produced in the U.S.

GLOCK and Heritage Mfg. — two manufacturers wholly focused on the production of pistols and revolvers, respectively — each produced, according to our records, top production figures in their histories in 2020. GLOCK was the fourth-largest handgun producer with 445,442 pistols. It achieved notable YOY growth in the “Up to .22” (41,000 to 128,157) and “Up to .50” (15,239 to 48,946) production categories. With 306,159 revolvers (and all but 808 of them in the “Up to. 22” category), Heritage was the top revolver producer in 2020 — a title it has possessed three of the past four years.

In the misc. firearms category, Anderson Mfg. was once again the top producer — a position it has held since SI began publishing the totals of this category in 2017.

International Business Trends

Coinciding with record levels of domestic demand, demand for U.S.-produced firearms experienced a boost in 2020. There were 519,350 firearms exported in 2020, a substantial 66.4% increase over 2019 (312,021) and fairly close to the record 548,111 firearms exported in 2018.

SIG SAUER was the leading exporter, with 254,019 total firearms exported in 2020. (Of those, 252,601 were pistols.) SIG has been the top U.S. exporter of pistols since 2016.

GLOCK, Ruger (top rifle exporter), Smith & Wesson (top revolver exporter) and O.F. Mossberg/Maverick Arms (top shotgun exporter) rounded out the top five exporters in 2020. Mossberg alone accounted for 91.8% of shotgun exports in 2020 (16,401 of 17,874).

Using the latest data from the U.S. Census Bureau, Economic Indicators Division, we can compare U.S. imports from 2020 and 2021. After experiencing a significant surge from 2019 to 2020, U.S. imports continued at a breakneck pace in 2021 — increasing from 6,164,710 to 9,136,453 firearms, a 48.2% jump.

As was the case in 2020, there were three countries with more than 1 million exports to the U.S. in 2021: Turkey (2,700,821), Austria (1,691,543) and Brazil (1,192,283). Three-quarters (75.5%) of the firearms imported from Turkey were shotguns — with most of them being semi-auto (780,289) and pump-action (768,261) shotguns.

(Editor’s Note: Imports of pump-action shotguns [HTS Code 9303200030] has been added into this year’s report — and will remain a fixture moving forward. 2020 data has been updated accordingly.)

All three major firearms categories recorded YOY increases in 2021. Handgun imports totaled 5,191,181, a 32.5% increase from 2020 (3,918,617); rifle imports jumped 47.4% (770,010 to 1,135,023); shotguns generated the greatest proportional growth (90.4%), increasing from 1,476,083 in 2020 to 2,810,516 in 2021.

U.S. Handgun Production 2020 (Top 100)

U.S. Pistol Production 2020 (Total >600)

U.S. Revolver Production 2020 (Top 25)

U.S. Long-Gun Production 2020 (Top 100)

U.S. Misc. Firearms Production 2020

U.S. Pistol Exports 2020 (Top 40)

U.S. Rifle Exports 2020 (Top 40)

U.S. Shotgun Exports 2020 (All)

U.S. Revolver Exports 2020 (All)

U.S. Misc. Firearms Exports 2020

Top U.S. Exporters 2020

U.S. Imports: Handguns (2020 & 2021)

U.S. Import: Rifles (2020 & 2021)

U.S. Imports: Shotguns (2020 & 2021)

A Look To 2021

The “uncertainty” theme of 2020 permeated throughout 2021 — with the supply chain challenges wreaking havoc on the U.S. firearms industry. With impressive import figures recorded in 2021, it will be compelling to see how domestic firearms production was impacted. We’ll know more soon when ATF releases its 2021 interim AFMER data, which is traditionally published later this month.

Let’s hear from you! Have a comment after reading this year’s report? Contact the SI team at editor@shootingindustry.com.