By The Numbers

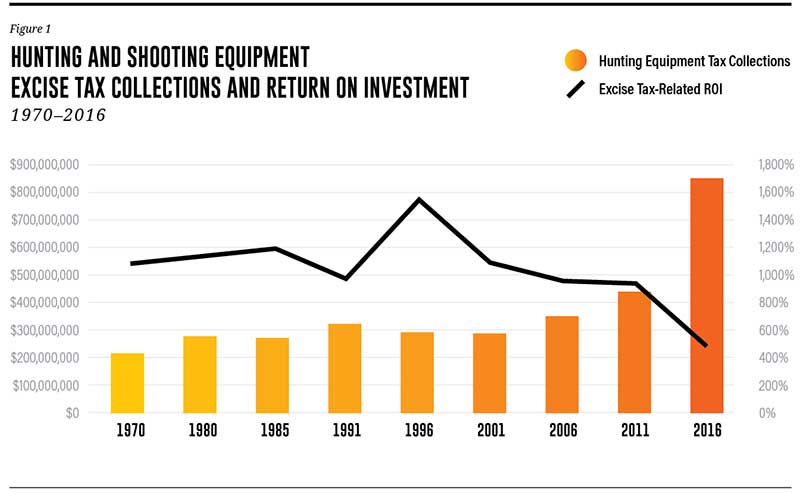

Since its inception, more than $13 billion has been collected and invested in wildlife restoration and hunting/shooting access in the U.S. Each year, over $600 million is generated and when matched as required by law, swells to nearly $1 billion. But as mentioned before, the dollars spent is not a measure of success.

At the big-picture level, more than 550 shooting ranges have been built or renovated in just the past five years with many more in the works. Over 1 million people receive their hunter education and safety training every three years. In the past few years, states have been rapidly expanding their hunter and shooter recruitment efforts.

Currently, these funds help maintain 47 million acres of publicly accessible lands for hunting. Keep in mind: The size of the hunting-related industry in 1937 was miniscule compared to today. Since then, states’ WRP-funded efforts and protected hunting license dollars have driven significant growth in hunting opportunities and sales. Without this program, wildlife populations would not have recovered, and hunting would likely have become irrelevant just as it has in many other developed nations around the world.