Finding The Balance

Point In 2020

TWO SIDES OF THE SAME COIN

Two basic components drive trends universally. Supply-side shocks are caused by availability of capital and raw materials, mergers and acquisitions, over- or under-production and similar issues. Demand-side effects are caused by shifts in consumer habits, either through a change in the number of consumers and/or adjustments in the amount of product purchased per consumer. Taking a look at both is very much “two sides of the same coin.”

One of the most noteworthy supply-side effects is the continued inventory difficulties at wholesale. With United Sporting Co.’s bankruptcy, a wave of inventory entered the picture. These items have clogged the pipeline, and are often sold below the manufacturer’s price.

When combined with other lingering inventory issues associated with the Bass Pro Shops/Cabela’s merger and other retail events, manufacturers are facing another hurdle in selling their product.

An additional supply-side change will also cause some further confusion for manufacturers, at least in the short-term. In the wake of Walmart’s Sept. announcement they’re no longer selling handgun ammunition, .223 and other calibers will cause some shifts in the supply chain. Walmart’s change certainly won’t reduce demand for these calibers, but instead will shift sales to other retailers in the long run. Some ammunition consumers will likely shift from Walmart to retailers they see as fully embracing the firearms community. Independent dealers certainly stand to benefit.

Considering many hunters and target shooters also buy non-shooting products such as hardware, clothes and other products while shopping for ammo, Walmart might see a slight dip in other categories, too. (This was apparently seen in the 1990s, when the footprint for outdoor sports was reduced across their stores.)

DESPITE SHORT-TERM INVENTORY AND SUPPLY-SIDE SHOCKS, THE CONSUMER IS STILL THERE.

For manufacturers, short-term costs will include shifting some distribution back to wholesalers and other retailers — plus boosting support for independent dealers. Once this transition is complete, the Walmart announcement should have little impact on most manufacturers, but it sure didn’t help manufacturers’ situation in 2019.

In response to softened demand after the 2016 presidential election, many firearm manufacturers have been burdened with excess manufacturing capacity and inventory. To move product, some manufacturers have discounted their products or combined various products to offer value package deals. After a lack of deals and sale pricing from 2009 to 2017, sales and discounts are now prevalent at retail.

This trend certainly lowers the margin per sale for the discounting firm, and others trying to maintain their product’s value see consumers shifting to the discounted brands — thus lowering their unit sales and impacting the bottom line. Once production and inventories reach manageable sizes, sales and discounts should start decreasing, resulting in better margins for manufacturers. Barring any new mergers or closures, we anticipate this happening within the year.

All is not negative. With Dick’s reduced firearms footprint, Sportsman’s Warehouse saw an opportunity and acquired many of Dick’s Field & Stream stores. This speaks to their belief, despite short-term inventory and supply-side shocks, the consumer is still there. Considering how recent consumer shifts caused many of the supply-side problems shared here (and how the firearms consumer might be misunderstood by many in the industry), let’s take a look at the consumer.

DEMAND-SIDE ISSUES & OPPORTUNITIES

Understanding consumer, or demand-side, issues and trends can help identify growth opportunities for smart companies. Consumer trends can be driven by external factors, such as the threat of restrictions on Americans’ Second Amendment rights, or internal trends, like increased interest in specific types of shooting activities or products.

Southwick Associates tracks firearms and accessories sales. One of our tools, the bi-monthly HunterSurvey and ShooterSurvey consumer panel, shows firearms enthusiasts are still buying products, albeit at lower rates than five years ago.

During this time, the percentage of our industry’s transactions that included a firearm or ammunition fell 17%, while the percentage of transactions with accessories dropped roughly 20%. This decrease is not consistent across all categories of firearms and accessories. Indications reveal premium products are doing better than those in the middle price range. (The picture is not clear regarding the lower-price ranges, and Southwick Associates will be launching new efforts in 2020 to provide better insights.)

However, political pressures could soon ramp up sales similar to the trade’s experience in 2008. With the U.S. Senate and the White House currently poised to maintain Second Amendment rights, the portion of our consumer base buying on concerns of future sales restrictions was likely low in early 2019. As the presidential campaign progresses, Democratic Party candidates have been competing to appear more aggressive about restricting firearm sales. Their public pronouncements about reducing or eliminating Second Amendment rights will certainly help stoke more concerns among current and would-be firearm owners and drive greater sales in the short-term — again. In the long term, any success by anti-firearm politicos would certainly suppress overall consumer participation and sales.

RISING POTENTIAL FOR NEW CUSTOMERS

The industry may be positioned to realize new growth via more new customers. Recent research conducted by Southwick Associates for NSSF discovered roughly 24 million Americans who currently do not own a firearm have a high level of interest in doing so. Of these potential first-time buyers, approximately 10 million want a firearm for lifestyle and recreational purposes; 14 million desire the means to better protect themselves and their families. In 2019, additional research provided insights and personas for the major segments comprising these 24 million potential new customers.

EVEN WITH MEDIA COVERAGE HIGHLIGHTING SOFTNESS IN FIREARM SALES, THERE ARE REASONS TO BE OPTIMISTIC WE’RE FINALLY FINDING A NEW BALANCE POINT FOR OUR INDUSTRY.

For companies wanting to know more about connecting with first-time firearm consumers, details on these consumer segments can be found free of charge at www.southwickassociates.com/commercial/firearms-consumer-segmentation. Proprietary segmentation and persona insights are also available for current firearm owners.

Among this group of potential firearms purchasers is a segment aptly named “Anxious Buyers.” This segment represents 1.2 million Americans with a mild interest in recreational shooting and self-protection. However, as their name implies, ongoing public talk about potentially greater irearm restrictions will encourage them to buy “before it’s too late.” Not all will buy, of course, but if presidential candidates who are anti-gun maintain their stance, they’ll certainly help boost 2020’s overall firearms and ammunition sales volume and may be encouraging increased sales at this time.

CAUTION IN BACKGROUND CHECKS, IMPORTS

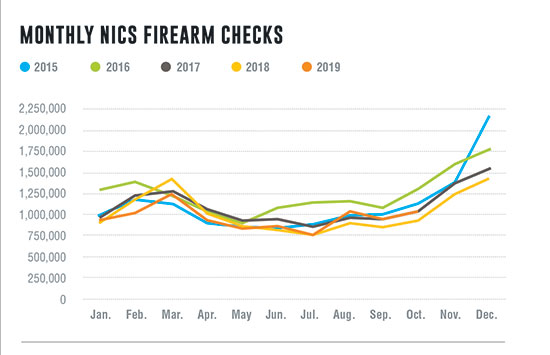

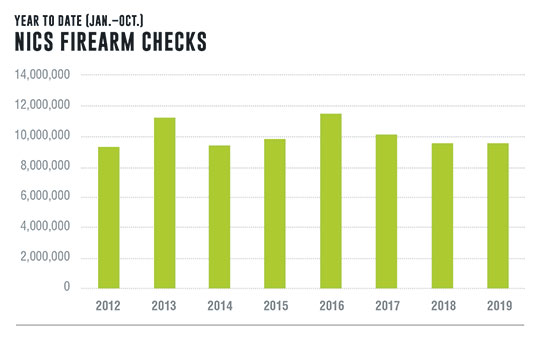

Regarding 2019 firearm sales, recent trends may be favoring our industry’s optimists. The FBI’s National Instant Criminal Background Check System, known as NICS, shows at the end of September 2019, NICS checks for firearms purchases overall were down 1% from 2018. (This excludes NICS checks made for purposes other than a firearm sale.) However, increases in the third quarter made up for the reduced checks in the first and second quarters. At this time, we think it’s too early to say if we’re seeing a long-term shift in sales demand or if the change is related to continued discounting, recent highly publicized firearm tragedies or the ongoing political commentary.

We do want to caution about using imports as an indicator of industry health as well as excise tax collection data. In a rush to beat new tariffs on raw materials and manufactured products, orders have increased with many intending to warehouse product until needed, at least those not using bonded warehouses. This intentional increase in inventory may not be reflected in consumer sales and will overstate sales in the near term if these data are used as a proxy measure of consumer demand. Likewise, intentional increases in inventory may also increase firearms and ammunition excise tax collections, potentially causing one to think consumer demand has increased more than it has.

PUTTING IT ALL TOGETHER

The 2019 business year brought further declines in firearm sales, although the rate of decline has slowed and is even showing recent upticks as of Oct. 2019. Changes continue within the retail landscape, plus shifts and closures within distribution have added to the challenge of conducting business. Even though consumers continue to shift toward buying online, the consumer is still there. It’s up to individual businesses to adapt to this online trend — a trend set to continue.

Through the first three quarters, 2019 has been flat compared to 2018. However, even with media coverage highlighting softness in firearm sales, there are reasons to be optimistic we’re finally finding a new balance point for our industry.

WHAT ABOUT 2020?

With 24 million Americans highly interested in purchasing their first firearm, politicians arguing for greater firearms restrictions are likely encouraging more first-time and repeat customers to visit a firearms counter, and with recent inventory pipeline clogs appearing to improve, 2020 holds promise for all levels of the firearms and accessories industry.

We expect sales to increase, both for firearms and accessories, and assuming no more major shocks to the supply-side, profitability will increase. More sales will occur online, so those firms with better positioning online will see improved numbers — both retailers and manufacturers.

Forecasting any future scenario that involves people is not like predicting the tide, but barring any major unforeseen events occuring either in the consumer, supply or political realms, we expect the trade to experience 1–3% growth in 2020.