2024 Industry Outlook

Economic Pressures, Perceived Supply Levels & Innovation Primed To Impact Buying Behavior

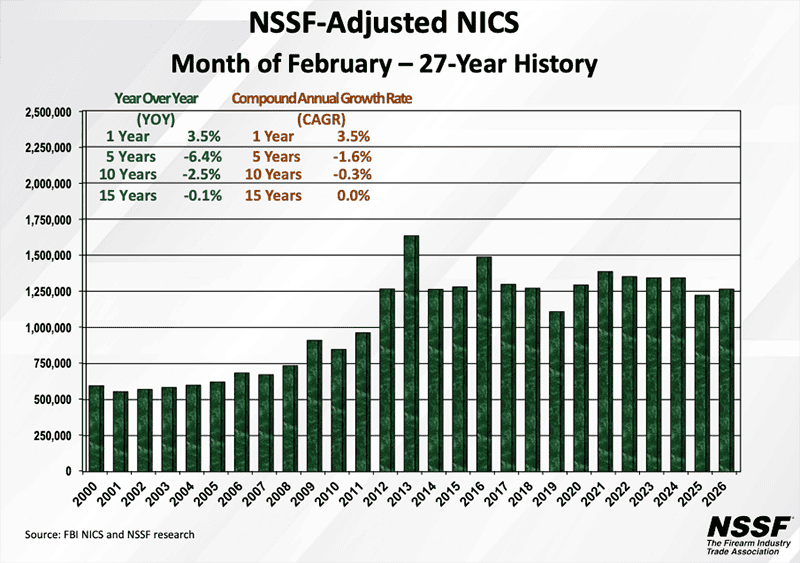

Looking back on 2023, some would say it was stronger than expected — while others would say the opposite. It all depends on where you stand in the market. As of the end of October 2023, NICS firearm background checks were down 6% over the same period in 2022, yet were still 21% higher than 2019, which has become the industry benchmark for the last “normal” year.

Though numbers above our 2019 NICS benchmark look good, they aren’t enough to move all of the high and stagnant firearm inventories throughout the distribution channel.

Additional insights from point-of-sale data, consumer perspectives and overall economic conditions help round out the picture for 2023 and point to where we are headed in 2024.

POS Data: The Gold Standard

Point-of-sale retail data is the gold standard when it comes to trends. Data representing more than 2,400 independent retailers from RetailBI, powered by Gearfire, indicates January to October same-store firearm inventories were down 5% versus the same months in 2022, while sales fell 16%. This trend reversed slightly in October, probably in response to the Maine shooting tragedy and the Israeli crisis, and likely does not represent a new long-term trend.

The greatest burden from these year-to-date (YTD) sales declines is falling on manufacturers who are probably seeing even greater declines in orders received. Despite price discounts and rebate promotions at retail, the average price paid for firearms was up 2.5%, indicating consumers may be using price promotions to buy more higher-end firearms than they would have otherwise.

Ammunition is experiencing a slightly different trend in the market. Ammunition inventory was up 6% through October 2023, according to RetailBI, powered by Gearfire, though there was a decline in October. YTD sales fell nearly 9%, with a jump in October. With declining sales and increasing inventories, ammunition prices are falling, with the average price paid down 11%. This also means ammunition manufacturers are likely seeing greater declines in replenishment orders as inventories become less of a concern for the consumer.

Lasting Impact From “The Surge”

Brand management has new challenges this year. During the surge when shelves were empty, retailers brought in brands they may not have offered before to ensure products were on the shelf to sell. As inventory then began to stack up, retailers focused on right-sizing their inventory — which included reducing their brand assortments. This has impacted many smaller and new market entrants.

The lack of open-to-buy dollars continues to limit orders for small and emerging brands. However, opportunities continue for lesser-known brands and products to remain in the assortment if they were well received during the surge and are now requested by consumers.

The Consumer Perspective

Though sales data may show one story, the ultimate retail sales driver is the consumer’s perspective. They may not view the market as we in the trade do.

Despite high inventories throughout the channel, according to Southwick Associates’ quarterly consumer tracking study, 20% of consumers reported firearms being less available in Q3 2023 than they were a year ago.

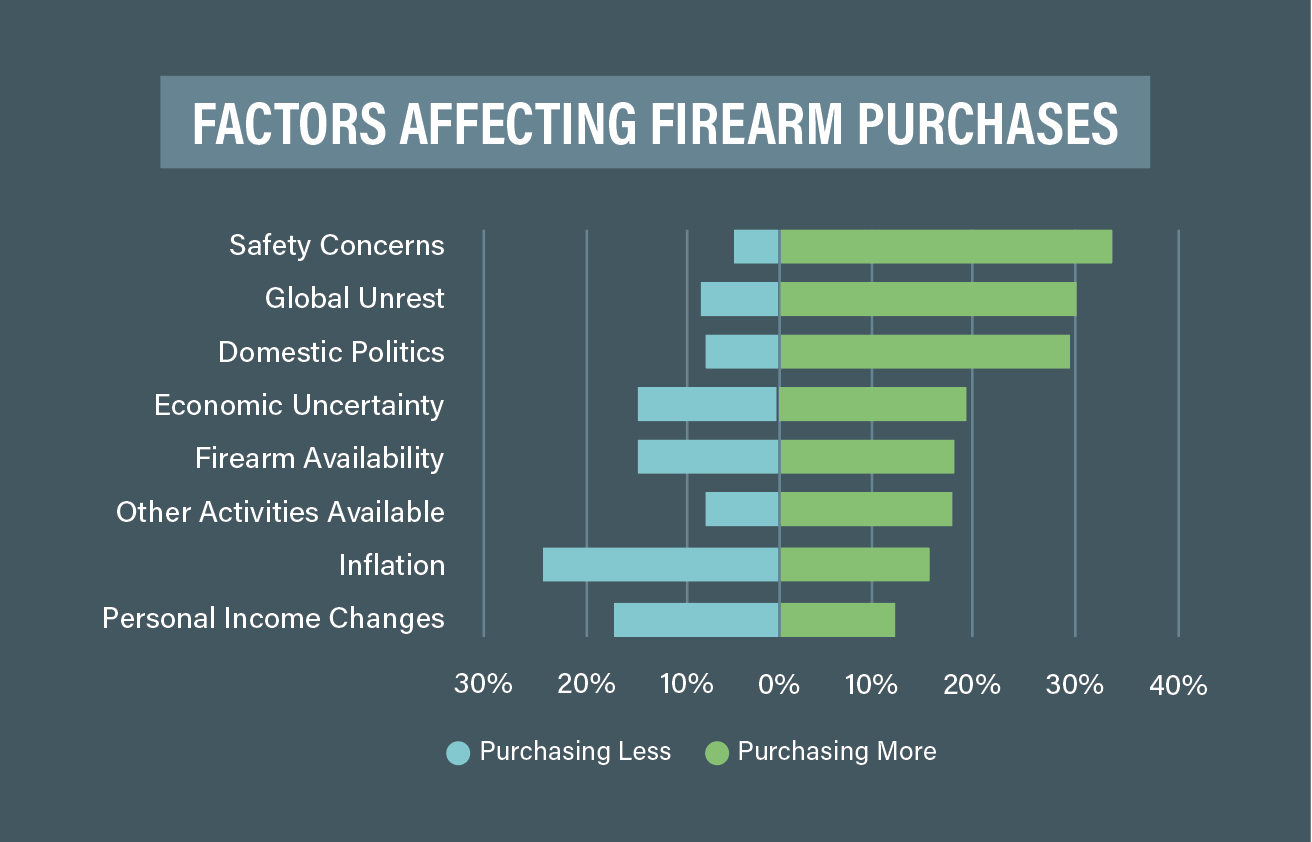

Other factors are affecting consumer demand for firearms, too. Offsetting increased demand from the minority of consumers who still see product shortages are inflation concerns, personal income changes and other economic uncertainties, as reported to us by consumers.

On the flip side, personal safety concerns, increasing global unrest and domestic politics are still driving consumers to purchase firearms.

Although consumer purchase intentions do not always turn into sales, in Q3 2023, 50% of firearm and accessory consumers reported they were interested in purchasing a firearm in the next 12 months. Nearly half revealed discounts and rebates would increase their likelihood of buying, followed by retail availability.

It seems the market is still primed for sales. During the surge, many companies put new products on hold to meet the demand at hand. However, during slow times, innovation drives new demand and keeps brands relevant.

With sales slowing, now is a good time for manufacturers to bring new ideas they have been sitting on to market. This opportunity is echoed by nearly a quarter of firearm consumers who indicated a newly introduced model would increase their likelihood of buying a firearm in the next year.

Remember, consumer perceptions are their reality. Availability of ammunition is still a concern for them, with 28% reporting ammunition was less available in Q3 2023 than a year ago. Just under 60% of consumers reported trying to buy ammunition in the last three months only to find it was out of stock.

In 2021, 70% of consumers reported to Southwick Associates their personal ammunition inventory was below their preferred level. This figure declined until the beginning of 2023. However, in the recent Q3 2023 survey, 50% report their ammunition inventory was below their preferred level.

Regardless of how much we might think consumers stockpiled ammunition in the past couple of years, only 8% report having personal ammunition inventory above their preferred level.

Like firearms, various factors are driving consumer ammunition purchases. Inflation, ammunition availability, personal income changes and economic uncertainty are factors causing consumers to purchase less ammunition. Meanwhile, safety concerns (self-defense), domestic politics, global unrest and acquiring a firearm are the key factors increasing ammunition purchases.

Economic Pressures

Various economic pressures now face consumers we haven’t seen in previous sales downturns. Although unemployment remains low, and inflation has been slowing since last year, consumers are feeling a pinch as disposable personal income has flattened.

It’s probable this trend will continue as unemployment ticks upward, though it should remain at healthy levels. Also, increasing credit card debt and late payments on credit cards and car loans indicate consumers may have less to spend.

Threats of a recession have loomed for some time now but have yet to come to fruition. Current thinking is a recession could happen in the first half of 2024, but the probability is falling and any recession would likely be mild and short. In the past, recessions have affected parts of the industry differently. While many do not lose their jobs during a recession, they will typically work fewer hours and have more time to participate.

During these times, many will hold off on larger purchases but will still purchase consumables or accessories such as ammunition, targets, reloading supplies, etc.

Looking Forward

For the past year, we have been advising the industry firearm and accessory sales would likely — over time — fall back to levels seen in 2016. This is a slightly higher level than 2019. We’re almost there, but not quite, so the market’s softening will conceivably continue into 2024.

Increased inventories are still certainly a concern. Manufacturers who have the ability to reduce output without having to pay for expensive unused capacity will likely be fine. Manufacturers who ramped up production and associated long-term debt during the 2020–2022 run will probably have a harder time going forward, especially with higher interest rates expected to remain in place.

We expect consumer interest and demand for firearms to remain strong, meaning retailers should expect sales to stabilize between the 2016–2017 levels, with localized exceptions as usual.

The challenge for our industry is to keep consumer interest high by offering new products and shooting opportunities, whether it is new shooting disciplines or greater access to ranges.

The consumer is still standing by our side, and it is up to us to manage capacity and inventories accordingly. Best of success in 2024!

Many of these insights are derived from proprietary data produced by Southwick Associates and are available to the industry. Additional reports are available regarding media usage by hunters and target shooters. For more information contact Nancy Bacon at Nancy@SouthwickAssociates.com.