U.S. FIREARMS INDUSTRY TODAY

Where’s The Election Year Demand?

Revisiting previous iterations of this story — notably in 2016 and 2020 — “fear” was a driving force in the marketplace.

In 2016, I wrote: “Sales are being driven by the intensified anti-gun/anti-industry rhetoric from leftwing politicians, with November’s general election near.” Four years later, in the first months of the pandemic and social unrest, I noted, “Amidst the uncertainty, the U.S. firearms industry is booming. Consumers have responded to events around them by visiting local dealers in unprecedented numbers.”

Here in 2024, there is still uncertainty in the marketplace — but a different kind. After so many once-in-a-generation events, “crisis fatigue” seems to be impacting sales across the firearms industry. Yes, the threat of federal action against firearms owners and the industry exists — but anti-gun efforts haven’t been as successful federally as they have at the state level.

The “Election Year Boon” of the previous election cycles appears absent — so far.

“If the election cycle is impacting our sales, it’s been slight,” shared Jacquelyn Clark, co-owner of Bristlecone Shooting, Training & Retail Center in Lakewood, Colo. “I do think things will eventually ramp up, like they always do in an election year, we’re just not seeing big effects yet.”

Kara Brown-Boesenberg, co-owner and executive VP of MKS Supply (marketer of Hi-Point firearms and Inland Mfg.), shared a telling observation of today’s market.

“For the current market, it’s promotionally driven. It seems everyone is cutting deals and lowering prices or adding value-added packages to help move products,” she stated.

In the past two election cycles, the phrase “promotionally driven sales” was not used in our industry. It begs the question: As we get closer to November, will there be another impetus to kickstart sales for consumers? Time will tell.

Legal Victories

The month of June brought two legal victories — one in the U.S. Supreme Court, and the other in a U.S. District Court. Both decisions addressed the limits of the ATF’s authority on rule-making.

While these advancements on a national level are welcoming, there are numerous threats at the state level — including California’s “sin tax” taking effect this month, the Colorado state legislature’s pursuit of anti-gun bills, New York’s impending implementation of a law forcing dealers to add warning signs in their establishment and more.

Garland v. Cargill

June 14, in a 6–3 decision, the U.S. Supreme Court ruled a semi-auto rifle equipped with a bump stock is not a machinegun. The case, known as Garland v. Cargill, challenged ATF’s sudden decision to include bump stocks under the definition of “machinegun” in response to the tragic mass shooting on the Las Vegas Strip in October 2017.

Writing for the majority, Associate Justice Clarence Thomas noted, “We hold that a semiautomatic rifle equipped with a bump stock is not a ‘machinegun’ because it cannot fire more than one shot ‘by a single function of the trigger.’ And, even if it could, it would not do so ‘automatically.’ ATF therefore exceeded its statutory authority by issuing a Rule that classifies bump stocks as machineguns.”

“This is a significant victory for gun owners because it reminds the ATF it simply cannot rewrite federal law,” said SAF Founder and Executive Vice President Alan Gottlieb. “The agency has just been reminded that it can only enforce the law, not usurp the authority of Congress.”

In response to this decision, President Joe Biden reiterated a familiar appeal to Congress: “I call on Congress to ban bump stocks, pass an assault weapon ban and take additional action to save lives — send me a bill and I will sign it immediately.”

Mock v. Garland

A day earlier, June 13, the Firearms Policy Coalition (FPC) announced a significant legal victory in its Mock v. Garland lawsuit challenging the Biden administration’s “pistol brace” ban rule issued by ATF. In the decision, U.S. District Court Judge Reed O’Connor ruled the ATF’s pistol brace rule violated the Administrative Procedure Act’s procedural requirements — granting summary judgment in favor of the plaintiffs and vacated the rule nationwide.

“Today’s order shows our community can take on an immoral government and win. We look forward to defending this victory on appeal and up to the Supreme Court, just as we have in other cases,” said FPC President Brandon Combs.

FPC expects the Mock decision and remedy to be appealed by the U.S. Department of Justice.

NICS Background Checks Jan. 2020–May 2024 (NSSF-Adjusted)

Top 40 U.S. Manufacturers 2022

NICS Background Checks: 1 Million Streak Continues

July 2019 was the last time NSSF-adjusted monthly NICS background checks totaled less than 1 million. From Aug. 2019 to May 2024, the closest NICS checks have come to 1 million was in Sept. 2019 — which totaled 1,011,636 checks. This current run of nearly five years of monthly checks exceeding 1 million is a record.

The most recent month available at press time, May 2024, totaled 1,089,117 NSSF-adjusted background checks — a drop of 7.2% from May 2023 (1,174,142). Each of the first five months of 2024 has trailed the corresponding month in 2023. NSSF-adjusted NICS checks so far in 2024 are 6.3% down from the first five months of 2023 (6,711,759 to 6,288,066).

Put in context, however, Jan–May 2024 NICS trends rank seventh in the all-time history of the NICS system — ahead of the 2016 election cycle (which had 6,179,528 checks through May 2016) and 2019 (5,317,913), the last “normal” year before the pandemic.

“We’re seeing some discounting to be sure, particularly if the manufacturer is only one product line deep or wide.”

Chris Killoy, CEO • Sturm, Ruger & Co.

Insights From Public Companies

Two of the industry’s most prolific firearms companies — although not in 2022, as we’ll soon evaluate — provide unique insights on the current market.

May 7, Ruger announced net sales for Q1 2024 were $136.8 million. For the corresponding quarter in 2023, net sales were $149.5 million. Q1 2024 net sales experienced an 8.5% drop from Q1 2023.

“Although the overall firearms market declined in the first quarter, demand for several of our product families remained strong,” observed Ruger CEO Chris Killoy.

According to Killoy, demand for Ruger’s 75th-anniversary models — Mark IV Target pistol, 10/22 rifles and LCP MAX pistol — remained robust, along with the American Rifle Generation II family of rifles, Mini-14 Tactical with slide-folding stock and LC Carbine chambered in .45 Auto. Sales of new products represented $42 million (or 32% of firearms sales) in Q1 2024 — rising from $30 million (or 21% of sales) in Q1 2023.

The estimated sell-through of Ruger’s products from independent distributors and retailers increased by 1% in Q1 compared to the prior year period. During the same period, NSSF-adjusted NICS background checks decreased by 4%.

During the quarter, Ruger made some strategic moves to ensure its long-term success in an ever-evolving firearms market. As part of this measure, Ruger undertook a reduction in force that impacted 80 employees, about half of which were reassigned to manufacturing positions.

In a May 8 webcast discussing Q1 2024 operating results, Killoy noted the prevalence of discounting in the market.

“We’re seeing some discounting to be sure, particularly if the manufacturer is only one product line deep or wide — for example, for folks who only make, say, the AR-15 platform. It’s tough for them in this market,” he said.

During the webcast, Killoy also shared modest annual price increases to products weren’t as widespread this year compared to previous years.

“Just based on the competitive nature of this market, we were not able to implement [the same] level of price increases this year,” he said.

June 20, Smith & Wesson announced its financial results for Q4 2024 and full fiscal year 2024, which ended April 30, 2024. Q4 2024 net sales were $159.1 million, an increase of $14.4 million (9.9%) over Q4 2023. For the full fiscal year, net sales were $535.8 million, an upswing of $56.6 million (11.8%) over the prior fiscal year.

President and CEO Mark Smith predicted demand will increase.

“While the summer months will be highly competitive as we navigate the traditionally slower season for firearms, we continue to expect healthy demand overall for firearms in fiscal 2025,” he said.

During a June 20 conference call with investors, Smith previewed a robust summer of promotional activity.

“We will be aggressively pursuing market share through promotions and marketing campaigns — in addition to building inventory in preparation for the busy fall season and continuing our cadence of new product introductions,” he said. “Specifically, with consumers increasingly price sensitive as inflation impacts discretionary spending, we will be focused on addressing this with new entry-level price launches this summer.”

Observations From 2022 AFMER Data

In March 2024, ATF released its 2022 Annual Firearms Manufacturing and Export Report (AFMER) — the most recent data available on firearms production in the U.S. (There’s a one-year delay in reporting to comply with the Trade Secrets Act — so 2023’s final figures will be made public next year.)

It’s important to note at the onset: these figures constitute the number of firearms sold or distributed into U.S. commerce by U.S. manufacturers during the 2022 calendar year (not total market share).

This data does not record firearms imported into the U.S. A second data set used in this special SI report comes from the U.S. Census Bureau, which delves into firearms imports — sorted by country of origin, rather than the importing company.

1. A Down Year, In Context

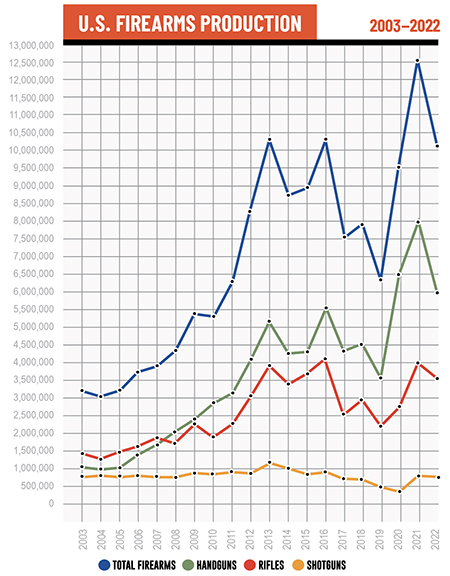

For the firearms industry, 2022 represented a “cooling” period relative to the unquenchable demand surge from first-time buyers and established users during the first years of the pandemic in 2020 and 2021. In 2021, U.S. firearms manufacturers produced a record-smashing 12,511,637 firearms. A year later, firearms manufacturing fell to 10,010,122 — a 20.1% drop.

As a result, 2022 ranks as the fourth most prolific year on record — behind 2016 (10,664,318) and 2013 (10,349,650), the only other years when the industry crossed the 10 million firearms threshold.

The industry’s cyclical nature is once again on full display. As noted in previous years, a YOY percentage change greater than 20 points has become fairly common in recent history. In the past 20 years, YOY swings greater than 20% has occurred eight times. This only occurred four times 1975–2011.

2. A Shakeup In The Top 3

For the first time since 2015, the top two U.S. firearms manufacturers didn’t consist of Ruger and Smith & Wesson. In that span, Ruger has been ranked as the most prolific firearms manufacturer five times (three for Smith & Wesson).

In 2022, Ruger reclaimed the top spot from Smith & Wesson — producing 1,562,014 firearms. This represents a drop of 24.6% from 2,071,897 in 2021.

But there was a newcomer ranked as the second-largest U.S. firearms manufacturer: SIG SAUER. Buoyed by its position as the top-ranked U.S. pistol producer (a position it last held in 2019), SIG SAUER was the only other manufacturer to produce more than 1 million firearms in 2022. Since 2018, SIG has consolidated its position as the third-largest U.S. firearms manufacturer — holding that mark from 2018–2021.

As noted above, this is the first time Smith & Wesson has been ranked outside of the top two since 2015. It produced a record amount of firearms in 2021 (2,312,313), and its total fell sharply in 2022 (973,268).

Total U.S. Firearm Production 2003–2022

3. Evaluating The Top 40

There is a significant amount of consolidation from the 40 largest U.S. firearms manufacturers: Together, they produced 9,296,342 (92.9% of all firearms made in the U.S.) in 2022.

Among the top 40, a number of manufacturers bucked the trend and posted YOY production increases in 2022: Savage Arms, Henry USA, Beretta USA, Colt’s Mfg., RemArms, Daniel Defense, Shadow Systems, American Tactical, Outdoor Colors, Browning, Staccato, Walther Arms, Bear Creek Arsenal, CMMG and RWC Group.

Savage Arms achieved a notable YOY increase in all three product categories it competes in: pistols jumped from 635 to 8,774, rifles grew from 392,880 to 608,579 and shotguns increased nearly eightfold from 13,352 to 102,288. Savage was the fourth-largest manufacturer in 2022, up three spots from seventh in 2021.

RemArms experienced significant improvement from 2021 to 2022, rising from the 26th-largest manufacturer to the 17th.

Outdoor Colors was another significant mover — it didn’t even make the top 50 in 2021 (54), but catapulted up to the 30th-largest U.S. firearm manufacturer in 2022.

Bear Creek Arsenal produced 9,486 firearms in 2021 and was the 72nd-largest manufacturer. A year later, its production more than tripled to 29,541, placing it as the 35th-largest U.S. firearms maker.

On the other side of the coin, some firearms manufacturers experienced considerable YOY decreases. Of greatest significance, Smith & Wesson’s production fell from a record 2,312,313 in 2021 to under 1 million in 2022 (973,268) — a 57.9% YOY reduction. Its YOY pistol production shrunk 62% (from 1,649,540 to 626,461). Combining its pistol and revolver production, Smith & Wesson was the third-largest handgun producer in 2022.

Heritage Mfg., the sixth-largest producer of firearms in 2021, dropped 39.1% (from 505,601 to 308,040). It was, however, the top revolver maker for the fourth year in a row.

Other manufacturers in the top 40 with sizable YOY drops include: Legacy Sports (-64.9%), IWI US (-49.2%) and SCCY Firearms (-47.8%).

For the first time since 2015, the top two U.S. firearms manufacturers didn’t consist of Ruger and Smith & Wesson.

U.S. Handgun Production 2022

U.S. Pistol Production 2022 (Top 40)

4. Pistol Production

U.S. pistol production fell just over a quarter (25.8%) in 2022, from a record 6,751,919 in 2021 to 5,011,167.

Of little surprise, 9mm production dominated the pistol landscape once again — accounting for 56.5% of all pistols produced in 2022. SIG SAUER produced more than double its next nearest challenger in the 9mm category (Smith & Wesson). GLOCK, Ruger and Taurus rounded out the top five 9mm pistol producers.

9mm production fell from 4,301,814 in 2021 to 2,832,422 in 2022 (-34.2%). Out of the 40 top pistol producers from 2022, only Springfield Armory, Shadow Systems, Diamondback Firearms, Staccato and Walther expanded production in this caliber.

Despite the YOY decrease in overall pistol production, 2022 was able to compete with 2021 in a couple of pistol categories.

Rimfire production experienced only a slight YOY decrease (-0.7%), with pistols in the .22 category totaling 732,028 in 2022 (737,374 in 2021). No doubt, SIG SAUER’s entrance into the rimfire category elevated this category. In 2021, SIG produced a single pistol in this category. This figure jumped to 77,938 in 2022 (the year the P322 launched). Bond Arms was another new entrant in this market, with the Rawhide .22 LR and Stinger RS .22 introduced in 2022. Taurus, GLOCK, Browning and Outdoor Colors attained notable YOY success in .22 pistol production, as well.

The .50-caliber category (which includes 10mm and .45 ACP pistols) achieved modest YOY growth, rising from 682,779 to 713,866 (4.5%). Springfield Armory was the top producer in this pistol caliber category, expanding its production from 113,911 to 169,964 (49.2%). At the end of 2021, Springfield Armory unveiled Emissary 1911 pistol variants, the Garrison 1911, Ronin EMP and other models, which likely buoyed its presence in this category in 2022.

5. Revolver Production

In 2021, U.S. revolver production topped 1 million. In 2022, production in this category contracted by nearly a third (-28.4%) to 830,786. As noted above, Heritage Mfg. was the top-producing revolver maker for the fourth year running, but it experienced a sizable decrease (-41.7%). Coinciding with its YOY decrease, Heritage Mfg.’s proportion of revolver production also dropped. In 2021, it accounted for 42.5% of revolvers produced in the U.S. This number fell to 34.6.% in 2022.

While 2022 rimfire pistol production eclipsed 2021 figures, rimfire revolver production declined from 781,246 to 437,653 (-44%). Revolver production in larger calibers, however, outperformed 2021 totals — with .357, .44 and .50 categories growing in 2022.

Colt’s Mfg. was the fourth-largest revolver maker in 2021 and 2022, but its revolver count increased significantly YOY, from 65,062 in 2021 to 98,839 (51.9%). Diamondback Firearms’ production in the .22 category (the Diamondback Sidekick) soared in 2022 — rising from 432 in 2021 to 12,458.

U.S. Revolver Production 2022

6. Long-Gun & Misc. Production

After a substantial rebound in 2021, long-gun production in 2022 was down — but still represented the sixth-highest total in the past 20 years. Rifle production equaled 3,505,819, down from 3,934,374 (-10.9%) in 2021 and shotgun production decreased slightly (-1.9%) from 675,526 to 662,350.

Totaling 710,867 rifles and shotguns, Savage Arms was the top long-gun producer in 2022 (it was fourth in 2021). Ruger had been the top long-gun producer for each of the previous four years. Savage achieved incredible YOY growth, its rifle production jumped from 392,880 to 608,579 (54.9%) and its shotgun production expanded from 13,352 to 102,288 (more than 600%). In total, its YOY growth in long guns amounted to 75% (from 406,232 to 710,867).

Ruger has ranked as the first or second most prolific long-gun producer every year since 2013. Ranked second in 2022, its YOY production dipped 5.7% (from 736,693 to 694,412).

Miscellaneous firearms production, not factored into a manufacturer’s total firearms production in this report, was the only category that featured an increase in 2022. YOY production in this category rose dramatically — from 1,283,282 in 2021 to 2,171,255 (69.2%). This is the highest total observed since SI began tracking this data in 2017.

O.F. Mossberg/Maverick Arms was the leader in this category, accounting for nearly half of the misc. firearms produced in 2022 (1,058,459).

U.S. Long-Gun Production 2022

U.S. Misc. Firearms Production 2022

7. Exports

Despite the dip in domestic firearms production in 2022, U.S. exports increased YOY — from 450,342 in 2021 to 548,196 (21.7%). Every category, other than revolvers, improved YOY.

For the first time since 2013, GLOCK was the largest U.S. exporter. It achieved admirable 84.6% YOY growth in pistol exports (67,106 to 123,907).

Ruger held as the second-largest U.S. exporter in 2022, a position it has maintained since 2019. Its export totals increased YOY, from 78,215 to 85,666 — a 9.5% jump.

After holding the title as the largest U.S. exporter for each of the previous two years, SIG SAUER dropped to third in AFMER rankings. Its YOY exports fell 26.1% (from 102,514 to 75,740).

Top U.S. Exporters 2022

8. Imports

Using the latest data from the U.S. Census Bureau, import data from 2022 and 2023 is available.

In 2023, handgun imports recorded a 14.5% drop-off from 2022 (from 4,380,653 to 3,744,958). The top three handgun importers in 2022 — Austria, Brazil and Germany — were also the top three in 2023. Austria and Germany recorded YOY dips (-17.5% and -1.4%, respectively), while Brazil’s climbed slightly (1.7%) in 2023.

Unlike handgun and shotgun imports, rifle imports posted a YOY increase — albeit a very slight one, at 0.5% — from 2022 to 2023 (1,113,286 to 1,118,923). Brazil, Canada and Spain rounded out the top three importing countries in 2023 (in 2022, Canada and Brazil were flipped). Brazil and Spain posted YOY increases (26.3% and 23.8%, respectively), while Canada dropped considerably (-42.1%).

Shotgun imports fell from 1,399,133 in 2022 to 977,863 in 2023 (-30.1%). The top three importers in 2023 were Turkey, Italy and Brazil. (China was the third-largest importing country in 2022, falling one spot to fourth in 2023.) Two of the three top countries in 2023 registered YOY declines — Turkey (-30.4%), Italy (-24.6%) — while Brazil’s 2023 total increased (31.4%).

Handguns — Imports 2022 & 2023

Rifles – U.S. Imports 2022 & 2023

Shotguns – U.S. Imports 2022 & 2023

Up Next: 2023 Firearms Production

The ATF will be releasing its interim 2023 AFMER data later this year — typically during summer — which will feature fresh totals for consideration. The full 2023 AFMER data, featuring breakdowns by FFL licensee, will be available in early 2025.

It’s likely the broad softening of the market observed in the 2023 business year will result in lower figures in the interim report.

Until then, we’ll wait — and look forward to presenting the 2025 “U.S. Firearms Industry Today” report next July.