Shaping Business — Through Data

One of the challenges facing the firearms industry today (and, perhaps all businesses these days) is consistent unpredictability.

Depending on your niche in the market, 2023 was most likely “flat” compared to the early years of the pandemic — but still elevated over previous demand surges.

Here in the early weeks of 2024, there is still an air of uncertainty — especially with the election looming and potential increasing instability in the Middle East, as well as the continuing war in Ukraine. As such, having access to and harnessing data has never been more important.

NASGW President Kenyon Gleason, in a July 2021 article published here in Shooting Industry, likened running a business without using data to flying a plane in the clouds without the proper instruments.

“As a relatively new pilot, I’ve learned quickly your aircraft instruments are your best friends. They can get you out of a jam and they can alert you to an issue so you have more time to react and adjust,” he wrote. “As the old saying goes, ‘Every takeoff is optional, every landing is mandatory.’ And when you’re in flight, your instruments and the data and feedback they give you can help to ensure that when that landing comes due, you’ll be ready, and you can make it with confidence.”

This analogy translates well to the shooting sports business.

“If you’re just flying by the seat of your pants and aren’t using sales data and information to help guide your business decisions, then you’re probably — more often than not — flying through the clouds with no instruments,” Gleason reasoned.

Thankfully, there’s a treasure trove of information available (many are gratis for macro-level data) out there in the industry. NSSF, NASGW SCOPE, Southwick Associates, GunBroker.EasyExport and Gearfire RetailBI represent a handful of the many trusted resources available. NSSF recently released some key findings from a survey that point to opportunities for further growth.

Firearm Ownership & Sports Shooting Participation Survey

In mid-January, NSSF released its “Firearm Ownership & Sport Shooting Participation in the U.S. in 2022” report (which is free to NSSF members). The report highlights 24.1% growth of adult participation in sport shooting in America from 2009 to 2022. Surveys indicate during that time, sport shooting participation grew from 34 million adult participants to more than 63.5 million.

According to the results of the survey, recreational sports shooting with a handgun saw the highest levels of adult participation. Though recreational target shooting at indoor ranges endured a downturn during the lockdown phase of the pandemic, the survey revealed participation levels at indoor ranges have since recovered to pre-COVID levels — an encouraging sign.

Additionally, in 2022, 17% of all adults participating in the shooting sports were newcomers. This represented 42% growth since 2020.

In a statement analyzing these results, NSSF said, “Today’s recreational marksmen and women are more representative of a broader scope of American demographic groups, increasingly urban and represented by women.”

If our industry can continue diversifying participation here in 2024, it will surely benefit us in the long run.

Rounding Out 2023 NICS Figures

The Dec. 2023 NSSF-adjusted National Instant Criminal Background Check System (NICS) figure of 1,775,834 is an increase of 1.6% compared to the December 2022 figure of 1,747,506 (NSSF-adjusted).

It’s now been more than four years — 53 months running — since there has been a single month with less than 1 million adjusted background checks.

The Q4 2023 NSSF-adjusted NICS figure of 4,742,029 reflects an increase of 4.6% compared to the 4,532,341 figure for Q4 2022. All three months of Q4 2023 exceeded the corresponding 2022 months (NSSF-adjusted).

The annual 2023 NSSF-adjusted NICS figure of 15,848,055 reflects a decrease of 3.5% compared to the 16,425,484 figure for annual 2022. 2023 represented the fourth-highest year on record, exceeded by years 2020–2022.

As we’re well aware, NICS figures don’t tell the whole story — but they do provide good insight into consumer behavior. For more than four years now, consumers have continued to demonstrate an elevated interest in firearms ownership. Relating to the previous section, the onus is on us to continue welcoming them in and capturing additional sales.

Throughout this year in Shooting Industry, we will be featuring articles on how to further diversify, as well as using data to inform decision-making. We welcome your feedback on what works best at your store or range.

Early SHOT Show Impressions

Writing this after Day One of SHOT Show 2024, one thing is abundantly clear — the industry has turned out in droves to uncover new products, make fresh connections and support one another. Even with its largest exhibit footprint ever, SHOT Show’s miles of aisles still felt a little crowded at times.

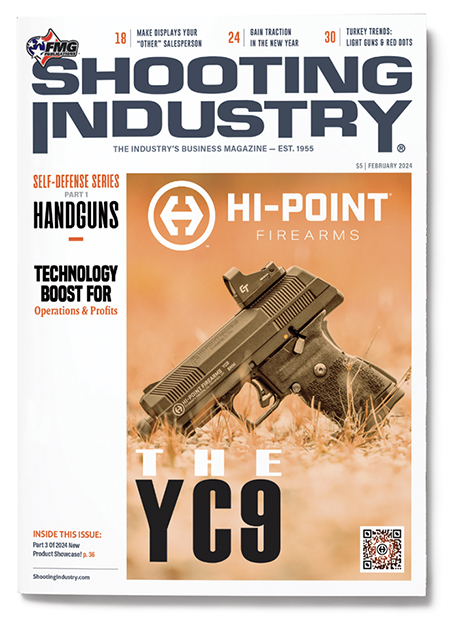

If I could use one word to describe a common theme on the first day of the show it would be “diversification” — category leaders are branching out into new categories. Smith & Wesson released its first-ever lever gun. Daniel Defense launched its first handgun. 2011 manufacturer Staccato unveiled two ammunition lines. After more than 75 years of taking countless four-legged game for rifle hunters, Remington Core-Lokt Handgun is now available. And I could keep going …

After years of trying to keep up with rampant demand, it looks as though an emphasis on R&D is back — and will be a big factor as we move deeper into 2024. Long may it continue!