U.S. Firearms Industry

Today — 2023

Is The Market “Normalizing” After Years Of Volatility?

Midway through 2023, the U.S. firearms industry finds itself in an unfamiliar position compared to recent history. After dramatic ups and downs over the past decade, things have been relatively “stable” over the past year and a half. The record-breaking demand surge has abated, yet is still above pre-pandemic levels in most cases.

Legal challenges at the federal and — especially — state level remain, impacting consumer behavior. Nevertheless, the U.S. firearms industry finds itself in a position of strength today. It has weathered the market volatility of the past few years and continues to welcome first-time firearms owners daily.

Growing Economic Impact

In the long term, the U.S. firearms and ammunition industry’s economic impact has been on a steady growth curve.

According to NSSF’s 2023 Annual Firearm and Ammunition Industry Economic Impact Report, the industry’s total economic impact jumped 322% from 2008 to 2022 ($19.1 billion to $80.73 billion). In the same span, the total number of full-time equivalent jobs rose 136% (from 166,000 to 393,696).

On a year-over-year (YOY) basis, the industry’s economic impact increased 14.5% from $70.52 billion in 2021 to $80.73 billion in 2022, while total jobs increased 5.6% YOY (375,819 to 396,696).

“Ours is an industry that is consistently growing and innovating to meet the American demand for the highest-quality firearms and ammunition for lawful firearm ownership. Over 4.2 million Americans from all walks of life, for the first time, discovered and exercised their right to lawful firearm owners and safely participate in the recreational shooting sports last year,” said Joe Bartozzi, NSSF president and CEO.

Coinciding with this expansive growth, the industry is likewise paying more taxes that benefit the U.S. economy and conservation efforts.

“Since 2008, federal tax payments increased by 266%, Pittman-Robertson excise taxes that support wildlife conservation by 226% and state business taxes by 46%,” Bartozzi continued.

Speaking of excise tax contributions, the industry recently surpassed $16 billion in total contributions to the Pittman-Robertson fund. When adjusted for inflation, this totals more than $25 billion. From May 2022 to May 2023, the industry contributed more than $1 billion to conservation.

NICS Update

For 46 consecutive months — dating back to Aug. 2019 — each month has closed with more than 1 million NSSF-adjusted background checks. The most recent month available at press time, May 2023, recorded 1,174,142 background checks (a slight drop of 0.1% compared to May 2022 [1,174,791]).

Through the first five months of 2023, there have been 6,711,759 adjusted background checks. Putting this figure in a historical context, it ranks as the fifth-highest total to start a calendar year — trailing 2021 (8,501,879), 2020 (8,115,139), 2013 (7,085,881) and 2022 (6,747,238). Encouragingly, the YOY change from Jan.–May 2023 compared to the same period in 2022 is less than 1%.

Though NSSF-adjusted background checks aren’t a direct 1:1 correlation to firearm sales, they do provide a good comparison point to survey current market conditions. And there’s no question: Americans continue to exercise their Second Amendment rights in significant numbers.

“These figures show when Americans are concerned government authorities will deny them the full spectrum of their Second Amendment rights, they will respond by exercising those rights,” observed Mark Oliva, NSSF director, public affairs when polled by mass media outlets.

Financial Revelations

The two largest U.S. firearms manufacturers are also publicly traded, which provides insight into the real-time conditions at the top-producing brands. In 2021, Smith & Wesson and Ruger combined to manufacture 4,384,210 firearms between them — more than a third of total firearms produced (35%) in the U.S.

March 9, Smith & Wesson announced its Q3 fiscal 2023 results (for the three-month period ending Jan. 31, 2023), with net sales totaling $129 million. This represented a 27.4% drop from the same quarter in the previous year ($177.7 million). However, when comparing Q3 fiscal 2023 to the same fiscal 2020 quarter — prior to the start of the pandemic — the 2023 total is $1.6 million (1.3%) higher.

“Our results reflect the work our team has done to capitalize on the opportunity afforded by our flexible manufacturing model during the surge to fundamentally transform our business model as it relates to product mix and pricing,” said Mark Smith, president and CEO of Smith & Wesson. “Further, the firearm market remains healthy, with strong participation growth in recent years on top of a large and loyal base of core consumers.”

Smith & Wesson released its Q4 2023 and full fiscal 2023 financial results June 22, after press time for the print edition. (Editor’s Note: S&W’s Q4 2023 and full fiscal 2023 results will be included in the online version of this story.)

Feb. 22, 2023, Ruger reported its 2022 net sales totaled $595.8 million, a decline of 18.5% compared to 2021 ($730.7 million). Q4 2022 net sales were $149.2 million, down from the corresponding quarter in 2021 ($168 million). Q4 2022 marked an improvement over Q3 2022, which generated $139.4 million in net sales.

“Consumer demand in 2022 was below the level of demand in 2021, dampened in part by inflationary pressures, which often constrain discretionary spending,” observed Ruger CEO Chris Killoy. “Nevertheless, we’re encouraged by our increased quarterly sales and production in the fourth quarter.”

May 3, in Ruger’s most recent filings on its Q1 2023 sales, the company reported its net sales totaled $149.5 million — a 10.3% reduction from Q1 2022 ($166.6 million).

Reacting to Ruger’s Q1 2023 performance, Killoy observed: “We took a disciplined approach, targeted a production mix that better aligned with consumer demand and continued to responsibly manage our overall production levels to reflect market conditions as we did throughout 2022.”

“Ours is an industry that is consistently growing and innovating to meet the American demand for the highest-quality firearms and ammunition for lawful firearm ownership.”

Joe Bartozzi, President & CEO

NSSF

8 Observations From 2021 Production Data

In Jan. 2023, ATF released the 2021 Annual Firearms Manufacturing and Export Report (AFMER) — the most recent data available. (2022 production data is not yet public; there’s a one-year delay in reporting to comply with the Trade Secrets Act.)

Note: These totals represent firearms produced in the U.S., not sold — so it’s not entirely representative of market share. However, there’s no doubt a correlation exists between domestic firearms production and sales at the retail level.

Looking back at 2021, the demand surge that began with the onset of the pandemic, social unrest and turbulent election cycle in 2020 was still being fueled by uncertainty, the first year of Joe Biden’s presidency and the looming threat of legislative attacks from a Democrat-controlled Congress.

Firearms makers overcame the raw material shortages, supply chain challenges and shutdowns experienced in 2020 to set numerous records in 2021. Here’s a collection of notable insights we’ve gleaned from ATF’s 2021 AFMER data:

Top 100 U.S. Manufacturers 2021

1. Record Firearms Production

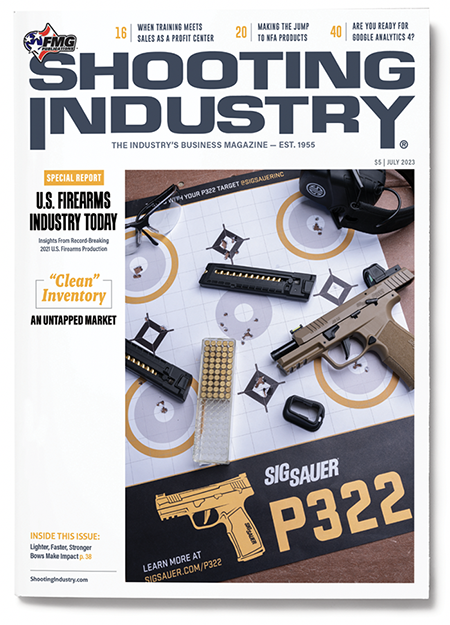

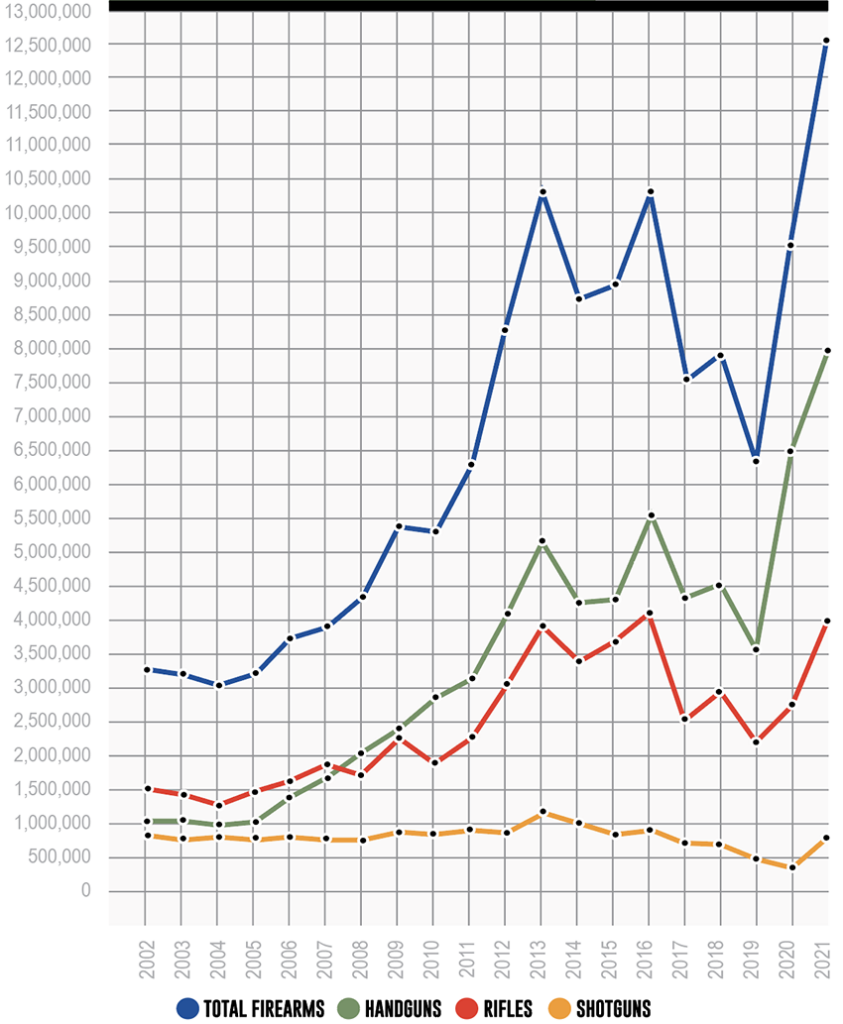

Let’s start with the most obvious: 2021 resulted in record firearms production, with 12,511,637 firearms produced. This smashed the previous record of 10,664,318, set in 2016 — an increase of 17.3%. YOY change was likewise significant, representing a 28.5% jump (there were 9,739,335 firearms produced in 2020).

Extreme year-over-year market volatility has become a recent phenomenon for firearms manufacturers. From 1975–2011, firearms production experienced YOY swings greater than 20% only four times. In the past 10 years alone (2012–2021), this has happened six times. Such swings without adjustments on the manufacturing side aren’t sustainable, which is why flexible manufacturing models and streamlined workflow processes are going to be key for firearms manufacturers moving forward.

In 2021, two firearms manufacturers exceeded the 2 million mark in the same year for the first time: Smith & Wesson (2,312,313) and Ruger (2,071,897). Between them, the 30 largest firearm produces in 2021 (as seen in the chart on p. 23) accounted for 90.1% of the firearms produced in the U.S.

U.S. Firearms Production (2002–2021)

Total U.S. Firearms Production 2002–2021

2. Handguns The Primary Driver

While all firearms categories experienced a YOY boost over 2020, handgun production was the cornerstone of the record total.

Nearly 8 million handguns were produced in 2021. If there were no other firearms produced that year, the handgun total alone would rank as the seventh-most prolific year on record. YOY production in handguns totaled 21.7% (from 6,502,261 in 2020 to 7,911,837 in 2021).

The top six handgun producers from 2020 were also the same in 2021: Smith & Wesson (1,882,016), Ruger (1,335,204), SIG SAUER (1,214,013), GLOCK (581,944), Heritage Mfg. (492,584) and Kimber (291,574).

U.S. Handgun Production 2021 (Top 100)

3. 9mm’s Dominance Grows

This won’t come as a surprise to anyone reading this, but 9mm pistols continue to dominate the U.S. pistol landscape. A record 4,301,814 9mm pistols were produced in 2021, capturing 63.7% of pistol production.

YOY 9mm production grew by 34%, and the category captured a greater proportion of the pistol market compared to the previous five years. In 2020, 9mm production represented 58.3% of pistol production, 56.7% in 2019, 54.1% in 2018, 47.6% in 2017 and 48.3% in 2016. There’s no debate: Pistols produced in 9mm continue to set the standard when it comes to U.S. firearms production.

SIG SAUER was the top 9mm producer, with 1,165,995 pistols. According to our records, 2021 was the first time SIG eclipsed the 1 million category in 9mm production for the U.S. market. (A note on SIG’s pistol production: It produced one .22-caliber pistol in 2021, later releasing the P322 March 2022 — a textbook case of why there’s a year delay in publicizing this data.)

U.S. Pistol Production 2021 (Top 100)

4. Milestone For Wheelguns

They may be viewed as “antiquated” by some of the industry’s newer entrants, but revolver production continues to prove detractors wrong. In 2021, more than 1 million revolvers were produced in the U.S. for the first time (1,159,918). YOY, revolver production rose 16.8% (from 993,078).

Heritage Mfg. dominated the category, producing 42% of all U.S.-made revolvers in 2021. Heritage has been the top producer of revolvers since 2019.

There were 781,246 .22-caliber revolvers produced in 2021, which made up more than two-thirds of all revolvers produced (67.4%). Heritage, Ruger and North American Arms were the most prolific providers of this popular plinking caliber.

U.S. Revolver Production 2021 (Top 25)

5. Long-Gun Rebound

Handgun production has outpaced long-gun production figures every year since 2016.

Rifle production’s dip in recent history hasn’t been as dramatic as shotguns, but both rebounded in 2021. Rifle production increased 42.5% over 2020 (from 2,760,392 to 3,934,374). Its 2021 total represents the third-highest figure on record, behind 2016 (4,239,335) and 2013 (3,979,570).

For the fourth year running, Ruger was the top long-gun producer in the U.S. Its total of 736,693 resulted in its highest total during that span. (In 2013, Ruger was the second-largest long-gun producer with 770,582, behind Remington’s 1,337,120.)

Of note, Springfield Armory was the second-largest producer of long guns in the U.S. — its highest ranking ever, according to our records. Its YOY rifle production represented a 90.6% jump (from 232,108 to 442,486).

Shotguns likewise experienced a robust YOY swing, with production increasing from a decades low 476,682 in 2020 to 675,426 (a 41.7% jump) — its highest level since 2016.

O.F. Mossberg & Sons was the top shotgun producer in 2021, a position it has held since 2017. Legacy Sports International has been the second-largest shotgun producer in each of the past two years on record.

U.S. Long-Gun Production 2021 (Top 100)

6. Misc. Firearms

While not factored in the total firearms production figures in this report, the miscellaneous firearms category was the only category to experience a slight YOY dip (-3.1%) in 2021. (However, it’s worth nothing Palmetto State Armory’s production statistics were not included in this year’s AFMER data. Considering it has been ranked as the second-largest producer in the misc. firearms category in each of the past five years, it’s a near certainty 2021’s total actually exceeded 2020.)

According to the AFMER data, there were 1,283,282 misc. firearms produced in 2021. Anderson Mfg. remained the top misc. firearms producer — a position its held since SI began tracking this data set in 2017 — growing 7.3% YOY (from 439,559 to 471,787).

U.S. Misc. Firearms Production 2021

“The firearm market remains healthy, with strong participation growth in recent years on top of a large and loyal base of core consumers.”

Mark Smith, President & CEO

Smith & Wesson

7. U.S. Exports Drop

In 2021, U.S. exports endured a YOY decline — shrinking 13.2% (from 519,350 to 450,342). In spite of the overall drop, exports of revolvers, rifles and shotguns improved from 2020 (rising 31.7%, 61.2%, 53.8%, respectively).

Accounting for more than half of total U.S. exports, a setback in pistol exports had a decisive impact on the overall export drop. Pistol exports totaled 237,194 in 2021, down 38% from 2020 (382,758). SIG SAUER (99,783), GLOCK (67,106) and Smith & Wesson (18,478) were the top pistol exporters in 2021 — each reporting YOY declines. SIG SAUER’s YOY reduction in pistol exports was 60.5% (from 252,601 to 99,783).

Despite this downtick in pistol exports, SIG SAUER was the largest U.S. firearms exporter for the second year in a row.

Buoyed by 63,162 rifle exports, Ruger was the largest long-gun exporter and second-largest U.S. exporter in 2021. YOY, its rifle exports ballooned 34.4% (from 46,993 to 63,162).

Top U.S. Exporters 2021

8. 2021 & 2022 Import Data

Using data from the U.S. Census Bureau, U.S. import figures from 2022 is readily available. In 2021, U.S. imports of handguns, rifles and shotguns totaled 9,140,862. Coinciding with a return to “normal” market conditions in 2022, total import figures fell 24.6% to 6,892,885.

Each of the three categories experienced a YOY decline: handguns (-15.6%), rifles (-2.3%) and shotguns (-50.2%).

Across the eight subcategories presented in the rifle and shotgun import charts, imports of bolt-action and center-fire NESOI rifles posted YOY increases in 2022. Imports from Finland and Japan contributed to the increase in bolt-action rifles, while imports from Brazil, Italy and Spain propelled the NESOI centerfire rifle category.

Despite the significant proportional drop from 2021 to 2022, shotgun imports have experienced sizable growth in recent years. From 2018 to 2022 imports of shotguns totaled 528,978, 573,075, 1,476,083, 2,810,516 and 1,399,133. The YOY drop from 2021 to 2022 marked the first YOY decline since 2017 (-10.1% from 2016).

The top three importing countries in 2021 carried over in the same order in 2022. 2022’s top importers were: Turkey (1,486,958), Austria (1,475,873) and Brazil (949,806). Each of these countries recorded YOY decreases (-44.9%, -12.7% and -20.3%, respectively).

U.S. Handgun Imports 2021 & 2022

U.S. Import: Rifles (2021 & 2022)

U.S. Imports: Shotguns (2021 & 2022)

2022 Production Data Coming

Typically, the ATF releases its interim AFMER data in summer — so 2022’s overall totals will be publicized shortly.

Using the analysis from Smith & Wesson, Ruger and 2022 import data as reference points, 2022 firearms production will likely remain above average but YOY totals will drop across the board after a record-setting 2021.