The Handgun Segment

Economy Slows Demand, But Stocking Options Abound

Coming out of the chaos caused by the COVID pandemic and social unrest, it’s not surprising handgun sales have slowed. When you combine a relatively calm period with economic uncertainty, there’s just not as much incentive for customers to buy more of what they already have.

Will this still be true in November and beyond?

We find ourselves once again facing the potential for unrest and upheaval as we head into the nation’s next election — a trigger for the kind of news that can spook current and would-be customers. But is it possible we’ve reached a point where politics and breaking news have lost the seismic power to shift the handgun market?

It’s not out of the question, suggests Patrick Hayden, owner of Kentucky Gun Company, in Bardstown, Ky. Like the rest of us, he has no crystal ball offering definitive answers. But after watching the turmoil of recent years, he’s starting to wonder if customers are growing immune.

“That’s not to say we can’t have another weird and unexpected event like COVID or World War III,” Hayden asserted, “but normal panic buying due to the normal news cycle doesn’t come into play anymore.”

At Wyoming Guns in Homosassa, Fla., owner Jay Castaline doesn’t disagree. Immediately after the attempted assassination of Donald Trump in July, Castaline took calls from several distributors urging him to stock up for what they suggested would be a new round of panic buying. He was unmoved.

“I told them we have enough inventory. I don’t need any more ammo and I don’t foresee people rushing out to buy a gun,” Castaline said. “I think the people who want guns have guns.”

Dave Larsen, owner of Doug’s Shoot’n Sports in Salt Lake City, isn’t ready to dismiss the idea of future market volatility. Instead, he thinks it’s more likely to be in hibernation for a half-dozen years or so — until today’s youngsters are old enough to create a new customer base.

With this in mind, he’s taking a cautious approach with inventory.

“I don’t plan on stocking up because I’m pretty heavy right now,” Larsen shared. “With the economy the way it is, people are still a little skittish with their finances. So, I don’t see a huge rush coming this fall.”

Kentucky Gun Company’s Patrick Hayden goes over the selling points of a snub-nosed

revolver with a customer. He contends current events are having less and less impact on

the market: “Normal panic buying due to the normal news cycle doesn’t come into play anymore.”

This echoes the “crisis fatigue” movement called out by dealers earlier this year in SI.

What Customers Want

Talking about the handgun market can feel somewhat repetitive. At stores across the nation, the top sellers tend to be the same. There aren’t many surprises to be found while listening to Castaline, in Florida, tick through his list of best sellers.

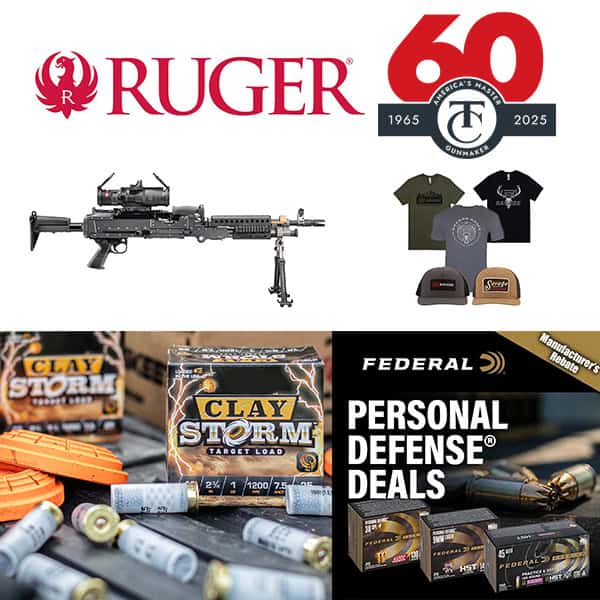

“The top gun, and it doesn’t matter what model it is, is the SIG P365. It’s just dominating the market,” he confirmed, before rattling off other favorite models by GLOCK, Ruger and Smith & Wesson.

Still, not every customer wants to walk out the door with the same gun everyone else has.

At Wyoming Guns, there’s growing interest in Canik — sales increased significantly during the first half of the year — and a rather unlikely carry gun: the Ruger LCP II in .22.

The latter sales are driven by the fact his shop is located within a community of a lot of retirees.

“They’re not looking for something that’s going to hurt their hands,” he explained. “They want something they can carry and can go out and shoot.”

In Kentucky, Hayden has seen fresh interest in .380 handguns, including the Ruger LCP MAX and the new Smith & Wesson BODYGUARD 2.0.

“I don’t want to say they’re having a resurgence, but there’s definitely an uptick in the sales on those,” said Hayden, who sees no reason to think they’ll replace the ultra-popular 9mm subcompacts. “Sometimes the platform is still just a little too big for concealed carry. Some people want a pocket gun or micro compact.”

Getting customers excited can be a bit of a challenge, particularly at a time when some manufacturers keep coming out with slight variations on existing models. But even some of these reworked or rebooted models have the potential to bring in customers.

Among the recent entrants attracting attention are the SIG SAUER P365-FUSE, Smith & Wesson’s M&P Carry Comp and the previously mentioned rework of the BODYGUARD.

Larsen, in Utah, likes what he’s been seeing, particularly with new metal frames, slide cuts, aggressive grip texture, better triggers and other extras.

“It’s a little more of a trend toward fancier or sexier guns,” he remarked. “The consumers are really going for that. They see the extra refinement. It’s like buying the car with leather seats and navigation.”

The Path Less Traveled

Gun stores would be boring places if they offered only a sea of top-selling handguns made by the top manufacturers. Those guns may represent the vast majority of your handgun sales, but there are always customers looking for something a little different. Figuring out which of those alternate brands and models to carry is the challenge.

Consider the Daniel Defense H9, a gun that drew strong interest following its initial release. Larsen has one on his range rental wall but says customer interest has cooled a bit.

“It gets a little bit of attention and I still have them on backorder. They’re definitely difficult to get,” he informed, “but people aren’t coming in asking for them right now.”

This is often the problem with the offerings by lesser-known handgun manufacturers, including some of the guns coming out of Turkey.

“A lot of those are great guns and a great value, but they’re tough to sell because people don’t know what they are,” Larsen said.

It doesn’t have to be a death knell for alternative manufacturers, suggests Castaline in Florida.

Though many customers are brand-sensitive, there are those who are willing to go in a different direction if they feel the value is there. This has worked for his Florida store, where makers like Tisas and Girsan have found willing buyers.

“You’ve got some brand guys and you’re never going to change them,” he asserted. “But you have guys who are just looking for value. You put two guns in their hands and they’ll ask why they should pay $900 for one when they can pay $500 for the other when they feel just the same.”

In Kentucky, Hayden has witnessed a strong uptick in sales of Staccato’s 2011s, something many other stores have also experienced. In general, though, there has been growing demand for budget-friendly double-stack 1911s, like Live Free Armory’s Apollo 11.

“Every manufacturer has a different name for it, but these double-stack 1911s have been pretty popular during the first half of the year now that there’s a handful of players in the sub-$1,000 price point,” he reasoned.

Although revolver sales have been flat for most makes and models, Hayden does expect a slight surge from a pair of new Smith & Wesson J-Frames (one in .38 Special and one in .32 H&R Magnum) offered through Lipsey’s with upgraded grips and sights.

“There’s been a high demand for those things,” he said. “They’re just now kind of starting to hit the market and they’re still extremely limited.”

Higher-End Sales

Handgun sales, in general, may be lackluster, but Hayden is seeing stronger performance from the higher end of the market. Of course, “high end” is a term where the definition varies from store to store.

At Kentucky Gun, it means firearms in the $2,000 to $5,000 range, from companies like Nighthawk Custom, Ed Brown, OA Defense and Staccato.

Exactly why this segment has outperformed all others this year is something of a mystery.

“It may be the buyers in that price point are not affected by the cost of living out there today,” he proposed. “They just have more disposable income and they’re still spending.”

It’s a similar story in Florida, where Castaline has seen a surge in customer interest in pricier guns by CZ and Wilson Combat: “Four years ago, I sold maybe 10 Wilson Combats. Now I’m selling 40.”

He attributes the sales increase to Wilson’s ability to put out quality guns in the $2,500 to $3,000 range.

“They’re not going back to the factory with issues of feeding and everything else,” he continued. “I think Wilson did their homework; I think they did a good job building it, they did a good job marketing it.”

A reminder that sales in one store are no guarantee of a similar trend elsewhere, Utah’s Larsen hasn’t seen the same surge, with his Nighthawks, Wilsons and Staccatos sticking around on shelves a little longer.

He sees the economy as the culprit.

“I think it is kind of dialing people back a little bit. I mean, back in 2022, everybody was putting a new gun in their gas tank every two months,” Larsen said. “There has been a little bit of a slowdown and people are being a little more conservative.”