2023 Industry Outlook

Despite grumblings from some corners, 2022 was strong from a historical perspective. On track to be the third highest year ever recorded for NICS background checks (at the time of publication in mid-December) sales are only exceeded by wildly crazy 2020 and 2021.

Where sales will go in 2023 is the multi-million-dollar question. Let’s tackle this question by first reviewing industry-specific trends in 2022, followed by current macroeconomic conditions and ending with our 2023 predictions.

Consumer Perceptions Driving Purchase Decisions

According to RetailBI powered by Gearfire, which has 2,400+ retailers reporting data, year-to-date October same-store independent retailer sales of ammunition and firearms declined 24% and 13%, respectively, compared to 2021. At the same time, inventories have increased, up 5% for firearms and 38% for ammunition — likely reducing orders at the wholesale and manufacturing levels. Unlike 2020–2022, prices remained generally stable. However, regardless of actual manufacturers’ shipments and retail inventory trends, consumer perceptions — not facts — drive purchasing decisions.

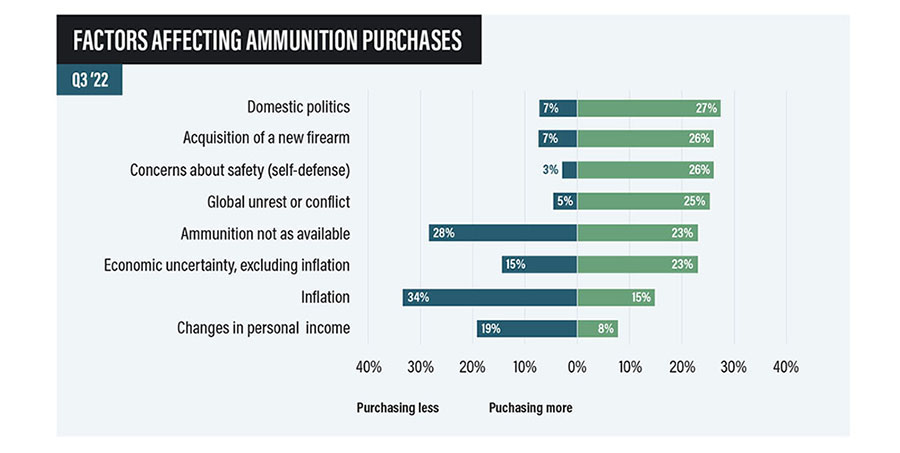

When it comes to ammunition, multiple factors impact demand (see “Factors Affecting Ammunition Purchases” chart below). All through 2022, inflation — both ammunition-specific price increases as well as economy-wide inflation — drove people to purchase less ammunition. It’s the top reason for falling demand. Concerns about ammunition shortages remained confused, with nearly the same percentage of consumers buying more and buying less for this reason. Domestic politics was the top motivator for buying more, followed by acquisition of a new firearm, safety concerns and, as we predicted earlier this year, global unrest round off the top concerns boosting ammunition demand. Lingering perceptions of supply shortages are still driving sales, but is the fifth-ranked factor for boosting sales, followed by economic uncertainty.

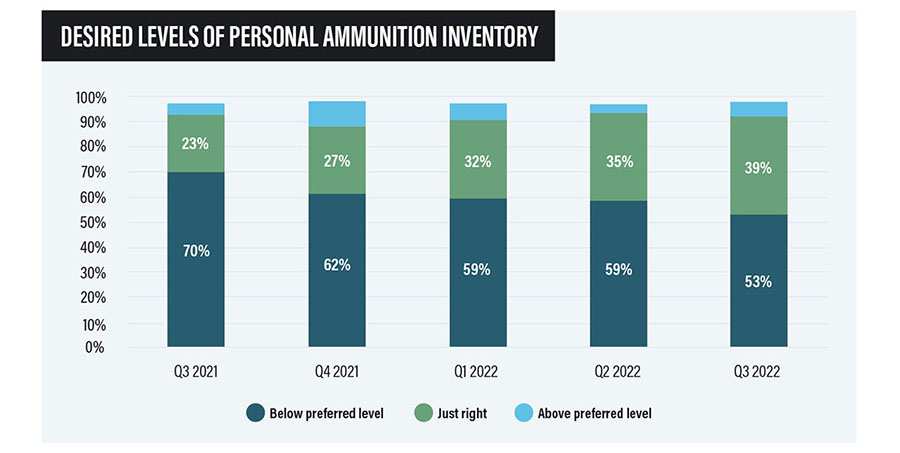

Despite some softening, ammunition demand continues to show greater strength than firearms. From October 2021 through October 2022 (see “Desired Levels Of Personal Ammunition Inventory” chart below), there was a steady decline in the percentage of ammunition consumers reporting their personal ammunition inventories were too low. However, more than half (53%) of respondents to Southwick Associates’ quarterly industry monitoring survey indicate they still want more ammunition, compared to 70% of respondents in October 2021. The strong demand for ammunition is diminishing, though at a lesser rate than experienced by firearms.

Consumers also see retail firearm inventories as improving. As of October 2022, 82% of shooting equipment consumers tracked by Southwick Associates report retail availability of firearms is steady or increasing versus 59% a year earlier.

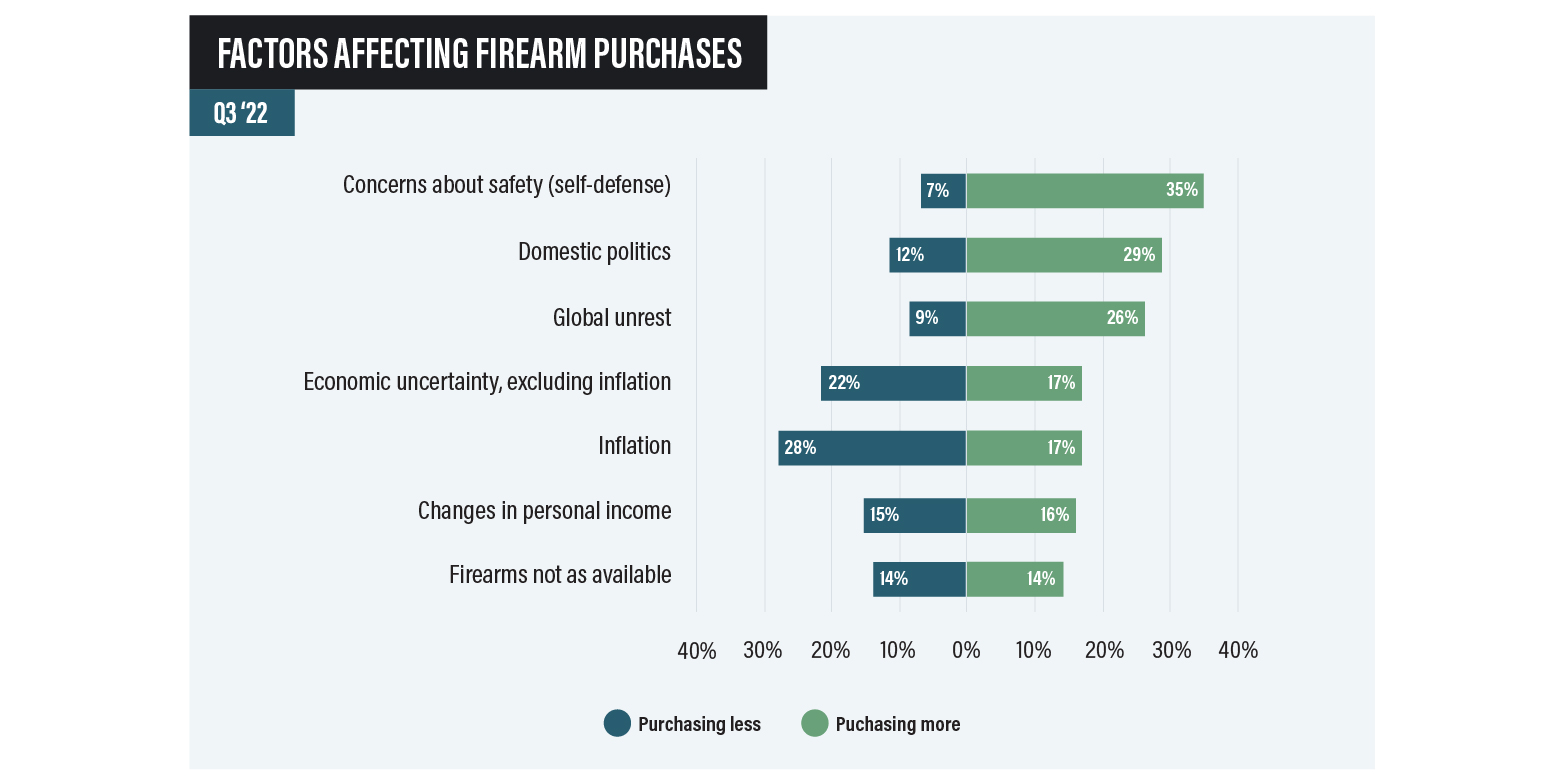

Just like ammunition, consumers’ perceptions and demand for firearms are driven by more than just supply concerns (see “Factors Affecting Firearms Purchases” chart below). By the end of October, the top three factors driving firearm sales were safety concerns, domestic politics and, as predicted earlier this year, global unrest. Inflation, which increases people’s concerns to obtain life’s basics, are having the greatest negative impact on sales, followed by economic issues — including job safety and changes in personal income. Perceived firearm shortages are the fourth highest factor depressing sales. As shown on the chart below, inflation has both positive and negative impacts on firearm demand, with a slightly greater negative impact overall.

Consumer perceptions of economic conditions have shifted significantly in 2022. In April 2022, only 10% of consumers indicated interest in purchasing a firearm was reduced due to economic uncertainty. However, by October 22% of consumers cited economic uncertainty as a major concern, with inflation becoming the biggest factor reducing firearm demand, up from 16% in April. This clearly illustrates that economic factors are weakening consumer demand for firearms as well as ammunition. We expect this concern and trend to continue into 2023.

Firearm, Accessory Sales Trends

Firearms sales are best tracked using the FBI’s NICS data. While 2022 NICs data are trending below 2021, they show sales in 2022 were still well above 2019’s pre-COVID levels. 2022 is on track to be the third best year ever for firearm retail sales. While this is a strong insight, concerns across the industry are justifiably focused on when the declines will level off.

Insights are also available for some accessory sales. Recent consumer segmentation research available from Southwick Associates explored firearms consumers’ purchase journey, including accessories. Results show firearm purchases are most frequently accompanied with ammunition, safety and storage gear purchases. In the months following their firearm purchases, consumers come back for accessories, either for dressing up their firearm, improving their skill or for enhancing their shooting and ownership experience.

In 2020–21, likely due to the increase in first-time purchasers, as well as return customers buying what they can, it appears a larger proportion of consumers were buying accessories at the same time as their firearm purchases. As firearm demand recedes, accessory sales will likely fall back to pre-2020 levels with greater percentages being purchased in the months following a firearm purchase versus at the time of purchase.

As for specific accessories, Southwick Associates’ quarterly industry monitoring survey indicates the percentage of hunters and target shooters purchasing optics has fallen behind 2020–21 levels, while reloading purchases are starting to increase, likely due to increasing inventory levels. Additional insights are available from Southwick Associates.

Though firearm imports have eased slightly from their peaks in mid-2021, they remain well ahead of previous record highs in 2016, 2014 and 2012. Imports in excess of current consumer demand is necessary to help restore retail and wholesale inventories depleted in 2020 and 2021.

However, we must be careful about bringing in too much, based on the excess issues associated with the famous “Trump Slump” years of 2017–2019. It appears the trade has already taken notice of building inventories and is closely managing them through discounts and other steps, in part with the insights now available from emerging inventory monitoring services.

Macro Issues

All industries and business sectors are impacted by outside forces. From unemployment to inflation, the firearms and accessories market is no different. Federal and private sector economists across the board are expecting a recession in 2023, if we’re not already in one now.

That said, we must be cautious and not compare the possible upcoming recession to previous recessions, since inflation is a significant factor for the first time since the 1970s. Unemployment remains unusually low, and while it will increase, it likely won’t reach levels seen in recent recessions. Though low rates of unemployment typically translate to greater consumer spending, inflation is increasingly suppressing this advantage by simultaneously reducing consumer demand and eroding manufacturer and retailer margins.

Another of many potential indicators of future sales is consumer debt. As of October 2022, credit card debt levels have returned to pre-pandemic levels, indicating consumers have less ability to spend like they did in 2021 and 2022. Likewise, with people returning to pre-pandemic activities, sales associated with recreational activities such as target shooting and hunting that surged during 2020’s various closures are also returning to “normal” levels.

Year after year, a top driver of firearm and ammo sales is political uncertainty. When elected officials talk about restricting the public’s ability to buy firearms and ammunition, sales increase. People want to buy before losing the right or ability to do so in the near future. With Republicans gaining control in the House of Representatives, political rhetoric regarding additional sales restrictions will decline, thus reducing demand.

Our prediction for 2023? Headwinds that reduce demand will dominate.

Final Call

Our prediction for 2023? Compared to 2022, headwinds that reduce demand will slightly dominate. Republicans gained control of the House, but barely. This will cause consumer concerns about future sales restrictions to ease somewhat — except in generally blue states and cities where pushes for greater restrictions on firearm sales and ownership will continue.

While inflation hasn’t appeared to reduce overall consumer demand much, simultaneously, consumers are gradually becoming aware of increased product availability at the retail level, which will reduce demand versus 2022. Firearm sales will ease but considering safety concerns associated with the potential recession and global military concerns, sales will not ease significantly. We expect 2023’s firearm sales to be in the ballpark of 2017 levels (Figure 4), which is above 2019’s sales volume.

These factors will accelerate discounting trends that began in 2022, likely dropping average firearm prices. Ammunition demand will also shrink though not as quickly as firearm sales. Manufacturers will likely feel the worse of it, as increasing retailer inventories will further reduce replenishment orders in 2023.

Predictions regarding accessory sales in 2023 is difficult. There’s no precedent to draw from, considering a recession is possibly accompanied simultaneously with lower-than-normal unemployment rates and rapid inflation. At this time, we suggest accessories demand will probably mirror firearms sales, as measured by NICS data. Efforts to encourage owners to shoot more often will certainly result in additional accessory sales.

Opportunities to create greater tailwinds exist. For many of our consumers, especially recreational shooters, firearm owners and target shooting is a way of life, and their numbers have grown in recent years. If they have income, shooting participation levels should continue, driving sales of our sector’s durable and consumable products.

These people, especially new shooting sports participants, are our best recruiters of new firearm and ammo consumers. Do what you can to promote time at the range to not only help encourage our current customers to shoot more often, but to also help support newly recruited customers.