Are We In A De-Evolution?

A Frank Discussion On Fixing The Firearms Industry

First things first: This article is not about the upcoming election, impending legislation, ATF weaponization or anything of the sort.

It has to do with the current state of the industry, and its ability to produce real profits from the hard goods we sell. (Not add-ons like a range, classes, membership revenue or the attached restaurant you built to diversify revenue.) This is solely a hard look at the items we buy at cost and sell at retail.

So, let’s rip off the bandage and open an honest conversation about the much-needed change this industry requires to be a healthier one — and thwart what could be a potential bankrupting of the industry if things don’t change, and soon!

$7/$10 From Two Categories

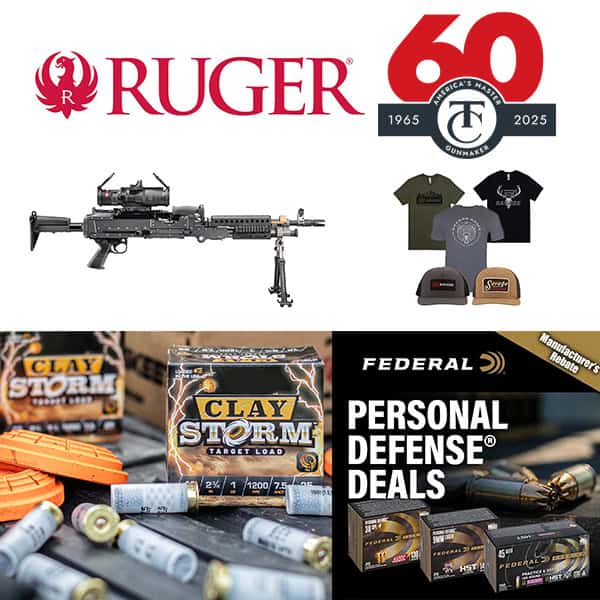

Based on data from thousands of retailers across the country, firearms alone consistently make north of 50% of the total retail hard goods dollars that change hands in our industry. This number can even swell to 60% when there are surges in interest. Ammunition is the next largest contributor to revenue in our industry, which typically ranges between 20%–30% of industry dollar volume at retail.

Combine the two, and they represent at least 70% of the annual industry revenue dollars. Let this soak in for a moment: $7 out of every $10 that crosses your counter is in two product categories. If we dig a little deeper, we find they’re amongst the lowest profit margin categories in our industry.

Firearms, as of early June, are averaging around 16.5% gross profit margin, and profit margins for ammunition fall somewhere around 25% for bulk-type range ammo and slightly higher for specialty ammo. What’s interesting is the cost of operating a business has increased during recent times, yet the profit metrics of these goods have stayed stable at best.

Based on data from the Bureau of Labor Statistics, the average hourly rate for a retail salesperson in the sporting goods industry was $12.55/hour in May 2019. Flash forward to May 2022 (the most current government data available) and costs climbed to $15.12/hour. Looking elsewhere, many other employment data sites show current estimates hovering around $16/hour (ZipRecruiter data February 2023). This is an increase since the pre-COVID era by 27.5%!

If this is what it takes to find (and retain) quality employees, then something must compensate elsewhere. In an already lean industry, when product margins stay the same yet the cost of operation dramatically increases, it creates a situation (particularly if sales volume is flat or in decline) where there is no way to dig out a profit at the end of the day.

So, who is to blame here? Let’s look at one side of the industry, the manufacturers.

Being Priced Out Of Business

The pricing of products is a complex topic spanning many factors, such as the state of the economy, cost of manufacturing and costs to promote and even implement strategic pricing to steal market share from the competition. You could spend years exploring and taking graduate-level courses to fully understand and master these complex dynamics.

When the rubber meets the road, however, one factor solidifying all these factors is “shelf price.” How is this determined? People far more intelligent than I sit at desks, hired by manufacturers to determine the sweet spot that will maximize their ability to produce healthy profits be it for their owners, or more significantly, shareholders.

Due to manufacturer marketing efforts, they hold, by far, the greatest sway on what the market price will ultimately be for the items they manufacture. But based on my 35 years in this industry, many do it with little to no regard for the profit needs of the retailers who sell their products.

Retailers turn those products back into the truly most valuable commodity — cash!

When MAP Becomes “Market Price”

Surveying many of the major brands in the firearm marketplace we experience a situation called Minimum Advertised Price (MAP), the lowest price at which a retailer and manufacturer agree to market their goods. I trust this concept started from a well-meaning idea to help stabilize the market space and establish a profitable price for all tiers of the industry. However, this has not turned out to be the case. Often, MAP price — regardless of MSRP — becomes the “Market Price.”

Many MAP price points seem to settle into the range of 8–14% gross profit margin on firearms. The big question: How is MAP pricing determined? In all my years of exploration, conversations and interrogation of professionals in the manufacturing space it boils down to two factors: 1) “We price our goods to be perceived as a great value compared to our competitors of similar products;” 2) “We want to position our products to be priced in the sweet spot of high-volume sales in the product’s target market space.”

In my 30+ years working in this industry, only one manufacturer has ever been able to describe their pricing structure from the viewpoint of the retailer to me. A manufacturer’s self-serving means of establishing MAP is an extremely myopic way of seeing the market space. This strategy forces the retailer community to create a profitable sale of a firearm (or other low-margin good) through add-on sales of other, higher-profit-margin goods or services.

Firearms-Only Not Enough

There is direct evidence of this industry-wide de-evolution. Some 20+ years ago, you’d find retail-only firearm establishments dotting the American landscape. At the time, the idea of an indoor range was a rare sight and often seen as a mecca worth driving multiple hours to experience. I recall living in Connecticut in the 1980s when a new indoor range opened in Bristol, and it sent the local firearm community all abuzz about this amazing new facility — the likes of which none of us had ever seen.

Flash-forward two decades, and suddenly the narrowing retail margins — largely determined by the manufacturers — started to make adding an indoor range a necessity and not just a curiosity to run a profitable operation.

In today’s market — considering the increased costs of operation due to staffing expenses, utilities and other post-COVID inflationary increases — we’re now seeing range/retail operations looking for new ways to diversify beyond the traditional sources of revenue to produce predictable and rewarding levels of profit.

Becoming Loss Leaders?

At the end of the day, we’re seeing sales of firearms, followed closely by ammunition, are about to (or already have) become loss leaders in our industry. It’s absurd to think these two goods alone aren’t enough to put retailers on the path to true, standalone profitability.

As noted above, as much as 70% of the cash changing hands in our industry is done at little to no net profitability and should be repulsive to anyone reading this. A large part of this is squarely the fault of an exploitative manufacturer-independent dealer ecosystem. For our industry to move forward in a healthy way, it shouldn’t be dependent on facilities operating expensive ranges or adding a restaurant just to post profits. Manufacturers need to work more closely with every rung of the industry ladder and keep every step profitable on its own — rather than retailer partners needing to be subsidized by other revenue streams.

Yes, the manufacturers shoulder a lot of blame for the negative impacts on the revenue health of our industry and for pushing it closer to the precipice of non-viability. After reading this I’m sure many of you are ready to run out of your businesses with a torch and pitchfork in hand, but I ask you to temper your frustration a bit until you read the next part of this article (publishing in the August 2024 issue).

As you’ll see, retailers have a lot of blame here as well. Yes, you, the retailer core, also bear a large part of the de-evolution of this industry — which is what we’ll focus on next month. We’ll see you there!